When Barack Obama was elected president the U.S. financial system and markets had been in tough form.

From the height in October 2007 by election day the S&P 500 was already within the midst of a 35% drawdown. By the point he was inaugurated in January 2009, the market was down practically 50% in whole.

By March, a Bloomberg opinion piece was calling it the “Obama Bear Market”:

President Barack Obama now has the excellence of presiding over his personal bear market. The Dow Jones Industrial Common has fallen 20 % since Inauguration Day, the quickest drop underneath a newly elected president in a minimum of 90 years, in line with information compiled by Bloomberg.

Michael Boskin of Stanford’s Hoover Establishment wrote an op-ed within the Wall Avenue Journal on March 6, 2009 with the next headline: “Obama’s Radicalism Is Killing the Dow.” He defined:

It’s arduous to not see the continued sell-off on Wall Avenue and the rising concern on Major Avenue as a product, a minimum of partly, of the conclusion that our new president’s insurance policies are designed to radically re-engineer the market-based U.S. financial system, not simply mitigate the recession and monetary disaster.

The inventory market bottomed three days later.1

From the day that op-ed was printed by the rest of Obama’s phrases in workplace, the S&P 500 was up 230% in whole.

All of the speaking heads had been flawed, principally as a result of individuals had been caught in a doom loop from the Nice Monetary Disaster.

The speaking heads had been flawed when Trump took workplace after Obama as properly.

Paul Krugman2 from the New York Instances made the next prediction the day after the election:

Nonetheless, I suppose individuals need a solution: If the query is when markets will get well, a first-pass reply is rarely.

The catastrophe for America and the world has so many elements that the financial ramifications are means down my record of issues to concern.

Dallas Mavericks proprietor Mark Cuban made an analogous assertion earlier than Trump was elected:

Within the occasion Donald wins, I’ve little doubt in my thoughts the market tanks. If the polls seem like there’s a good probability that Donald may win, I’ll put an enormous hedge on that’s over 100% of my fairness positions… that protects me simply in case he wins.

The inventory market did simply positive throughout Trump’s presidency, gaining greater than 90% in whole from inauguration day to inauguration day.

Trump himself was the one who predicted the inventory market would crash if Biden had been elected in 2020:

The inventory market did simply positive underneath Biden too, up greater than 90% since he took workplace in January 2020.

Typically occasions these predictions are politically motivated, however they’re additionally pushed by the momentum of the day. There’s loads of herding after an election.

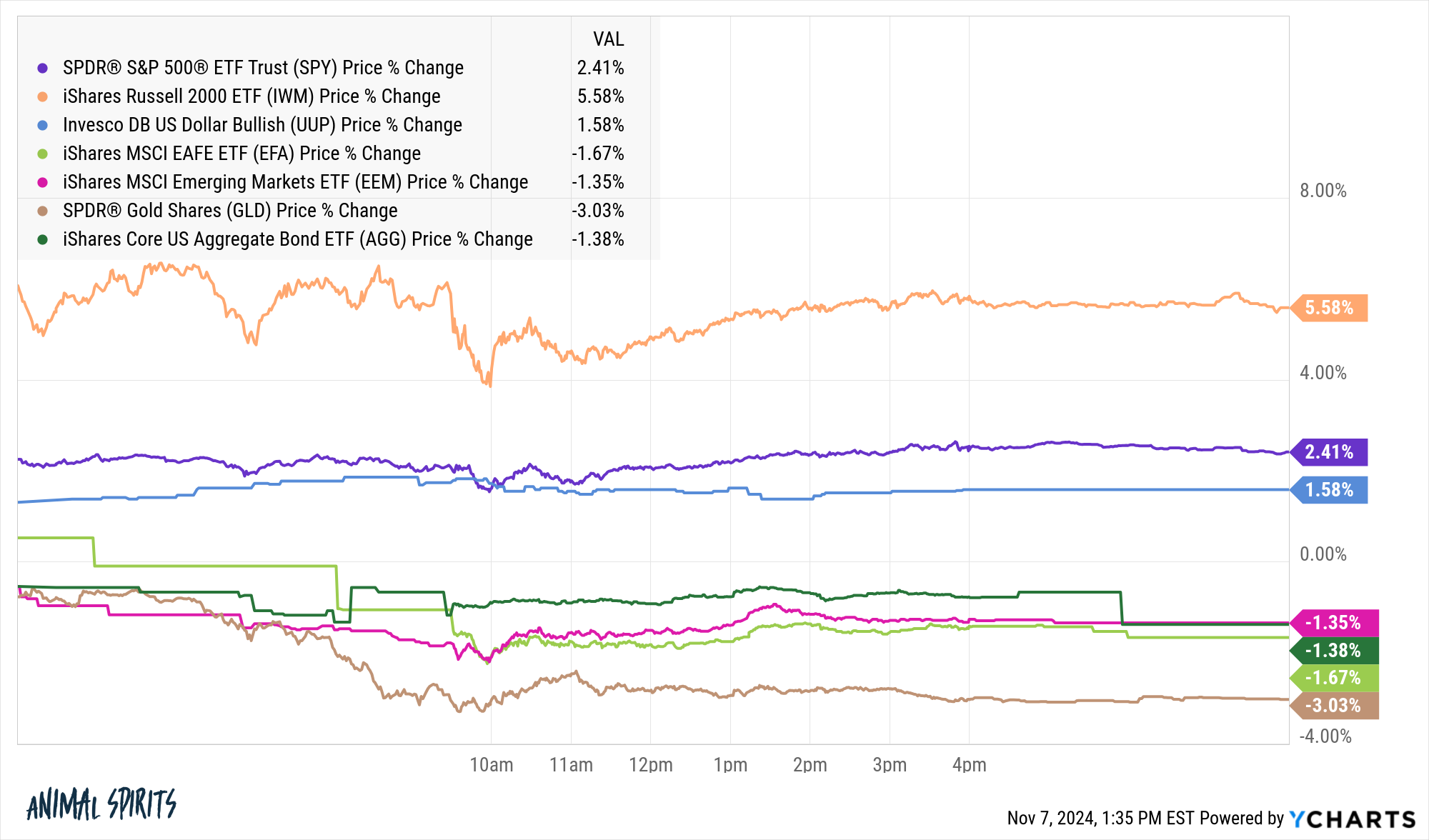

Which brings us to the present election. The market’s response was resoundingly constructive the day after Trump was elected:

Right here’s the abstract:

- The S&P 500 was up bigly (+2.4%)

- Small cap shares had been up massively (+5.6%)

- The U.S. greenback was up (+1.6%)

- Overseas and rising market shares had been down (-1.7% and -1.4%)

- Gold was down (-3.0%)

- Bonds had been down (-1.4%) as a result of charges had been up

- Bitcoin additionally charged to new all-time highs.

That was definitely an enormous response contemplating the inventory market was already up 20% in whole coming into election day.

Nobody appears to be making any crash predictions this time round. It’s (principally) all people within the pool. I’m nearly sure markets are overreacting not directly right here however I can’t say for positive the place it’s happening.

Small caps have given traders loads of head-fake rallies over time. Rates of interest have been rising and falling for a few years now too. It looks like a sure-thing bitcoin goes to learn however crypto’s historical past is suffering from booms adopted by busts.

If I needed to choose one I believe traders are too apprehensive concerning the rise in charges. We’ll see. I’m no good at predicting these things.

I suppose what I’m attempting to say right here is don’t take the preliminary response of the markets, the pundits or the economists as gospel. Nobody is aware of how it will prove, good or unhealthy.

The issue with politicians is that they make many guarantees on the marketing campaign path, a lot of which by no means come to fruition. So the markets are guessing about what is going to occur earlier than we’ve any of the small print. That is what markets do, in fact. Generally proper, generally flawed however by no means doubtful.

Making predictions primarily based on short-term worth actions is at all times a idiot’s errand nevertheless it’s in all probability much more vital to keep away from overreacting after an election when feelings are operating excessive.

Josh, Michael, Callie and I went stay at The Compound on Wednesday night to speak all concerning the market and financial impacts of the election:

And Michael and I gave some ideas on politics and investing the day earlier than the election:

Make sure that to subscribe to The Compound’s YouTube channel so that you by no means miss any of those movies.

Additional Studying:

Don’t Combine Politics With Your Portfolio

Now right here’s what I’ve been studying these days:

- The 2024 election and who tells your story (Eye on the Market)

- Slaying a number of the greatest passive investing boogeymen (FT)

- Investing classes from the 2024 election (Huge Image)

- We have to discuss retirement spending (Morningstar)

- The way to take care of disappointment (The Atlantic)

Books:

1On March 3, 2000, Obama mentioned it could be a very good time to purchase shares. He wasn’t pounding the desk nevertheless it’s humorous how there was truly pushback on that concept on the time.

2To be honest, Krugman did recant that assertion just a few days later.