Yesterday (December 19, 2024), the Australian authorities revealed their so-called – Mid-12 months Financial and Fiscal Outlook 2024-25 (MYEFO) – which principally supplies an up to date set of projections and statuses of the fiscal place six months after the key fiscal assertion was launched in Could. One would have thought the sky was falling in given the press protection within the final 24 hours. The usual of media commentary in Australia on fiscal issues is past the pail.

The press has gone into overdrive within the final 24 hours:

1. “Chalmers’ legacy a decade of deficits”.

2. “Australia’s finances deficit to balloon by $21.8 billion over subsequent 4 years”.

3. “Playing sector surprised by axing of tax breaks”.

4. “Actual large spender from the minute he walked into the joint”.

5. “MYEFO to sentence Labor to deficit”.

6. “Treasurer confirms horror financial information”.

7. “Greater and hidden deficits are the true MYEFO outcome”.

8. “Hovering MYEFO deficit delivers a wake-up name for Commonwealth Authorities”.

9. “Funds replace reveals deficits $21.8b worse than anticipated — because it occurred”.

10 “‘Not terrific’: MYEFO forecasts finances deficits”.

11. “the long run story ‘stays fairly worrying.’”

12. “the finances blowout”.

And on it went as copy editors competed with one another to forged a shadow of doom over the financial launch.

The Treasurer (Chalmers) didn’t assist issues claiming that “The distinction between breaching that $1 trillion, the couple of years distinction there, means an absolute mountain of demand and debt curiosity prevented within the meantime.”

On the final election, Chalmers turned a form of speaking monkey along with his fixed repetition of the mantra ‘the nation is heaving with a trillion {dollars} of debt’.

In every single place he spoke it was the ‘heaving’ line.

Advert nauseum, to say the least.

Now, conveniently, he ignores his personal warning.

And, for the file, it was a pathetic warning anyway.

The monetary market commentators that the nationwide broadcaster appears to depend on lately for alleged authoritative or knowledgeable commentary have been stuffed with “spending like a drunken sailor” and an array of different lurid metaphors which have zero that means within the context of a currency-issuing authorities.

One character was quoted as saying:

… the sobering actuality is that the extra the general public sector insists on spending, the much less non-public sector spending the RBA is prepared to tolerate.

Which sums up how unhealthy the commentary is.

The reasoning is all backwards right here.

The truth that the federal government has been spending extra currently is precisely as a result of the non-public sector is spending much less because of the RBA’s rogue financial coverage which is unnecessarily pushing the economic system in direction of recession.

If the RBA had not adopted its senseless rate of interest hikes we might have noticed two issues amongst others.

1. The inflation fee would have fallen anyway, on condition that the drivers weren’t associated to extreme spending (which is likely to be delicate in some ranges to rate of interest modifications).

2. Personal sector spending would have been stronger and because of the cyclical impacts on the fiscal steadiness – the fiscal deficit would have been smaller.

For these calling on the federal government to chop spending they conveniently ignore the truth that the one purpose that GDP development, weak as it’s, stays constructive, is due to the federal government spending.

I mentioned that subject on this latest weblog publish – British Labour Authorities is shedding the plot or somewhat is confirming their stripes (December 12, 2024).

Unsuspected listeners suppose these characters are ‘specialists’ when, in actual fact, they’re simply boosters for the profitability of their very own establishments.

The information

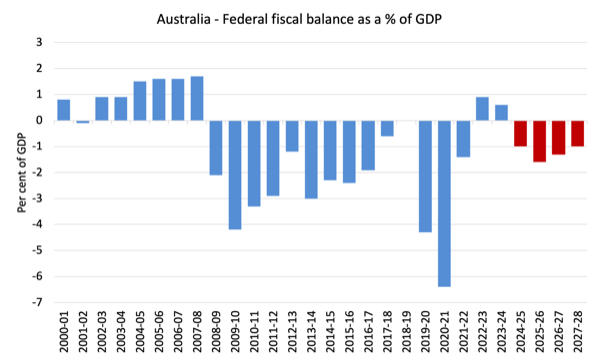

The next graph exhibits the fiscal steadiness for the reason that monetary yr 2000-01 with the final 4 (pink) columns being the so-called ahead estimates of the steadiness.

It’s a must to marvel what all of the fuss has been about.

The fiscal deficit is forecast to be 1.0 per cent of GDP within the coming monetary yr (2024-25) then rise to 1.6 per cent, earlier than dropping to 1.3 per cent and 1 per cent over the remaining two monetary years of the forecast interval.

Minuscule and definitely not massive sufficient to take care of the challenges that the nation faces with respect to local weather response, restoring some housing fairness, and boosting the failing schooling and well being sectors.

To fulfill these challenges, the fiscal steadiness goes to should be a lot bigger for a protracted interval – so you’ll be able to think about what number of coronary heart assaults there are going to be among the many media commentators as that actuality units in.

The press are touting the $A26,949 billion fiscal deficit determine as a result of they know that 1 per cent of GDP doesn’t sound scary sufficient.

If is farcical.

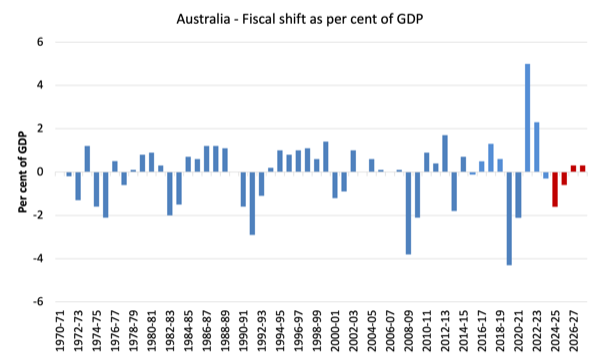

The next graph exhibits the fiscal shift from yr to yr when it comes to p.c of GDP.

So a constructive quantity means the fiscal place is changing into much less expansionary (when it comes to supporting development and employment), whereas a damaging quantity signifies the alternative.

So for all of the speak of ‘drunken sailors’, it seems the sailors are performing in a somewhat sober method.

For the final three years of the ahead estimates the federal government is planning to undertake a contractionary fiscal stance.

The following graph exhibits the evolution of federal authorities spending and income receipts from 1970-71 to 2027-28 (with the dotted traces being the ahead estimates).

This graph has led to claims that authorities spending is ‘uncontrolled’ and there’s a widening hole between tax income and spending.

One commentator disclosed his ignorance when he wrote:

Neither aspect of Australian politics has been prepared to have an ‘grownup dialog’ with the Australian individuals about how all this extra spending must be paid for … the burden is falling disproportionately on youthful generations (the identical ones who’re discovering it a lot tougher to grow to be home-owners than their mother and father or grandparents did).

It’s arduous to reply that form of commentary besides to say that if we actually wished the youthful generations to have higher entry to housing possession then we might require bigger deficits.

The housing disaster is basically as a result of abandonment by governments (federal and state) of their accountability to provide social housing, which has created a significant provide scarcity.

That abandonment coincided with the rising fetish for fiscal surpluses and the key cutbacks in authorities funding in housing infrastructure that adopted.

Additional, the extra spending (as he phrases it) is funded the second the pc operator within the authorities presses the spend button and credit seem within the banking system (or cheques are printed and mailed out).

The federal government can run a deficit endlessly with none burdens falling on the youthful era.

I additionally marvel what the response could be from these monetary market commentator varieties if the federal government determined to chop again spending by ending the heavy authorities subsidies to the elite non-public faculties (which get a disproportionate quantity of federal help).

Or, as well as, the federal authorities might at all times reduce its subsidies to the profit-seeking non-public well being system that serves the elites.

We are able to guess what the response could be.

The one subject I’d have with the present income combine, is that it’s closely weighted in direction of earnings taxes and which means lower-income earners who can not afford fancy accountants are paying a disproportionate share, whereas large companies who get authorities handouts, are capable of manipulate their books to keep away from paying any tax in some notable instances.

This remark shouldn’t be taken in any context that the tax income is funding the federal government spending.

The purpose is that the federal government has to take again a few of its spending within the type of taxes to create the ‘fiscal room’ (useful resource house) through which it could spend with out creating inflationary pressures.

Who ought to bear the burden of that course of?

Reply: Definitely not the low-income employees.

The present system is, sadly, forcing these employees to bear the burden.

The place is the expansion coming from?

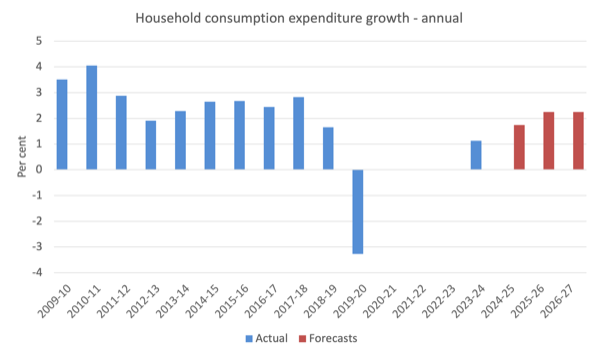

The 2024-25 fiscal assertion now forecast that actual family consumption expenditure will develop by 1.75 per cent in 2024-25, by 2.25 per cent in 2025-26.

The next graph exhibits the annual actual Family consumption expenditure development from 2009-10 to 2023-24, with the pink bars capturing the Authorities’s projections.

I took out the 2 early COVID observations given how excessive they have been (in both course).

Within the September-quarter 2024 nationwide accounts information, the annualised development was 0.4 per cent however the quarterly outcome was -0.04 per cent.

In different phrases, the federal government’s ahead estimates are very optimistic primarily based on what’s more likely to occur in 2024-25.

Usually we might anticipate family expenditure development of that magnitude to come back from a really robust actual wages development setting.

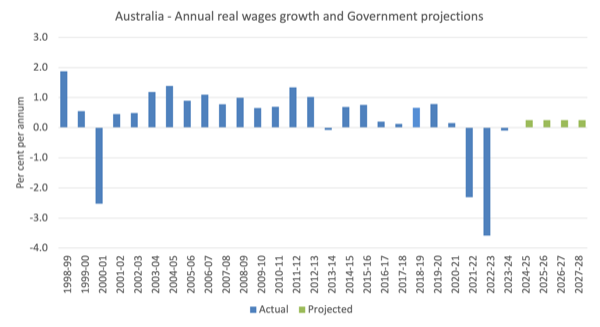

However wages development has been at file low ranges and the up to date fiscal assertion is projecting very modest the true wages development certainly on the again of some heroically optimistic nominal wages development estimates.

The next graph exhibits actual wages development out to 2027-28.

The underlying ahead estimates of nominal wages development are far too optimistic, which signifies that it’s unlikely that actual wages will develop a lot over the subsequent few years.

Conclusion: The Authorities is wanting us to return to the unsustainable state of affairs the place non-public debt escalates to keep up family consumption expenditure whereas wages development stays subdued.

We all know that the monetary steadiness between spending and earnings for the non-public home sector (S – I) equals the sum of the federal government monetary steadiness (G – T) plus the present account steadiness (CAB).

The sectoral balances equation is:

(1) (S – I) = (G – T) + CAB

which is interpreted as that means that authorities sector deficits (G – T > 0) and present account surpluses (CAD > 0) generate nationwide earnings and internet monetary property for the non-public home sector to internet save total (S – I > 0).

Conversely, authorities surpluses (G – T < 0) and present account deficits (CAD < 0) cut back nationwide earnings and undermine the capability of the non-public home sector to build up monetary property.

Expression (1) can be written as:

(2) [(S – I) – CAB] = (G – T)

the place the time period on the left-hand aspect [(S – I) – CAB] is the non-government sector monetary steadiness and is of equal and reverse signal to the federal government monetary steadiness.

That is the acquainted MMT assertion {that a} authorities sector deficit (surplus) is equal dollar-for-dollar to the non-government sector surplus (deficit).

The sectoral balances equation says that complete non-public financial savings (S) minus non-public funding (I) has to equal the general public deficit (spending, G minus taxes, T) plus internet exports (exports (X) minus imports (M)) plus internet earnings transfers.

All these relationships (equations) maintain as a matter of accounting.

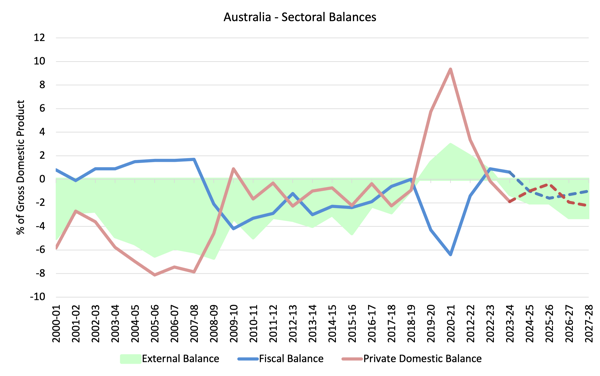

The next graph exhibits the sectoral steadiness aggregates in Australia for the fiscal years 2000-01 to 2027-28, with the ahead years utilizing the Treasury projections revealed within the up to date MYEFO assertion.

The projections start in 2024-25.

I’ve assumed that the exterior place forecast for 2026-27 will persist into the subsequent monetary yr.

That’s not a problematic assumption, on condition that the 2026-27 estimate could be very near the long term common.

All of the aggregates are expressed when it comes to the steadiness as a p.c of GDP.

I’ve modelled the fiscal deficit as a damaging quantity though it quantities to a constructive injection to the economic system. You additionally get to see the mirror picture relationship between it and the non-public steadiness extra clearly this fashion.

The dotted traces are the projections.

It’s apparent that through the early years of the pandemic, the enlarged fiscal deficits allowed the non-public home sector (households and companies) to elevate thie saving as a p.c of GDP.

With the fiscal tightening that adopted, the non-public home sector have been compelled into deficit total and that state of affairs persist because the exterior sector strikes again into deficit.

In different phrases, the fiscal deficit is simply too small to cowl the spending hole attributable to the increasing exterior deficit, which suggests the non-public home sector is unable to avoid wasting total.

Within the publish Nineties interval, the family sector, specifically, collected file ranges of (unsustainable) debt (that family saving ratio went damaging on this interval though traditionally it has been someplace between 10 and 15 per cent of disposable earnings).

The fiscal stimulus in 2008-09 noticed the fiscal steadiness return to the place it must be – in deficit. This not solely supported development but in addition allowed the non-public home sector to start out the method of rebalancing its precarious debt place.

Each time the federal government’s surplus obsession results in contractionary coverage modifications, the non-public home sector strikes into deficit.

Total, the technique outlined in yesterday’s fiscal assertion is as soon as once more putting the economic system on an unsustainable path counting on family debt accumulation.

And why didn’t the media join the times

It appears that evidently the media has a brief focus span.

One may forgive the journalists for forgetting what occurred final week, however to not join a significant information outcome yesterday to a different at this time demonstrates how little these commentators know.

Immediately (December 19, 2024), the Australian Bureau of Statistics launched the detailed – Australian Nationwide Accounts: Finance and Wealth.

In its press launch – Family wealth up 2.4% in September quarter – the ABS mentioned that:

Family wealth rose for the eighth quarter in a row, up 2.4 per cent or $401 billion within the September quarter 2024 … Complete family wealth was $16.9 trillion within the September quarter, which was 9.9 per cent ($1.5 trillion) greater than a yr in the past.

I’ll have extra to say about this information one other time.

However after yesterday’s doom projections in regards to the fiscal place, at this time the media, with out discover, shifted to extolling how good it was that personal home sector wealth had risen so strongly.

Not one commentator I learn or heard on the radio linked the 2 information releases.

It’s apparent that if the fiscal deficit was not rising modestly, the non-public home sector’s internet monetary place wouldn’t have improved because it did, given different elements.

I’ll clarify that extra rigorously in one other weblog publish.

However the truth that no-one picked up the direct causal connection tells us how little these ‘specialists’ really know.

There are additionally worrying facets to the wealth information.

The RBA’s ridiculous rate of interest hikes have allowed for a large redistribution of wealth from low-income mortgage holders to high-income holders of economic property.

That’s a part of the story too.

Conclusion

The usual of media commentary in Australia on fiscal issues is past the pail.

That’s sufficient for at this time!

(c) Copyright 2024 William Mitchell. All Rights Reserved.