Regardless of increased mortgage charges and elevated dwelling costs, current dwelling gross sales jumped to an 8-month excessive in November, marking the second month of annual enhance in additional than three years, based on the Nationwide Affiliation of Realtors (NAR).

Whereas stock improves and the Fed continues reducing charges, the market faces headwinds as mortgage charges are anticipated to remain above 6% for longer on account of an anticipated slower easing tempo in 2025. The extended charges might proceed to discourage owners from buying and selling current mortgages for brand new ones with increased charges, preserving provide tight and costs elevated. Nonetheless, as mortgage charges proceed trending decrease, the gradual enchancment in stock ought to assist gradual dwelling value progress and improve affordability. As such, the latest good points for current dwelling gross sales might give approach within the coming months of information.

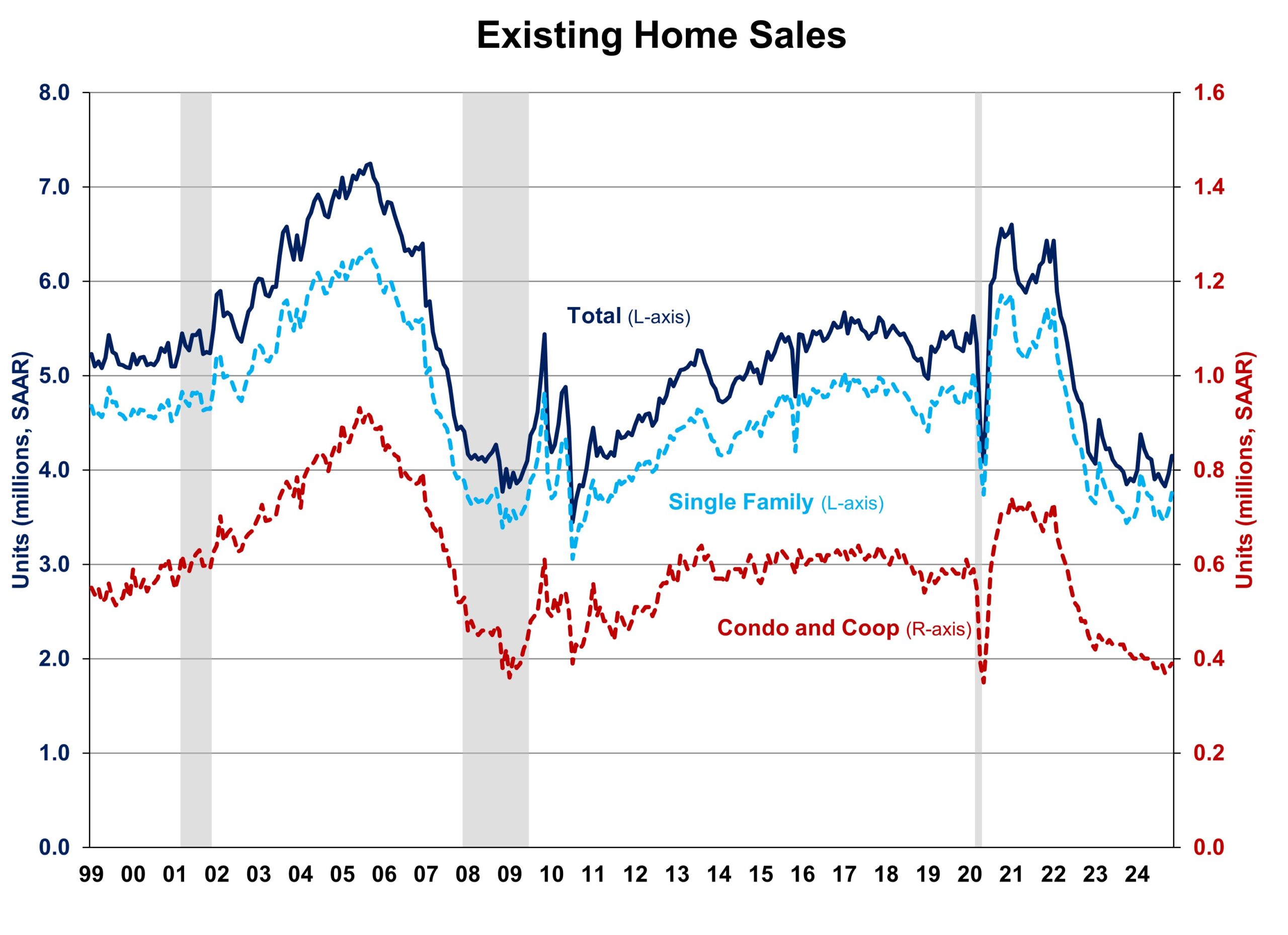

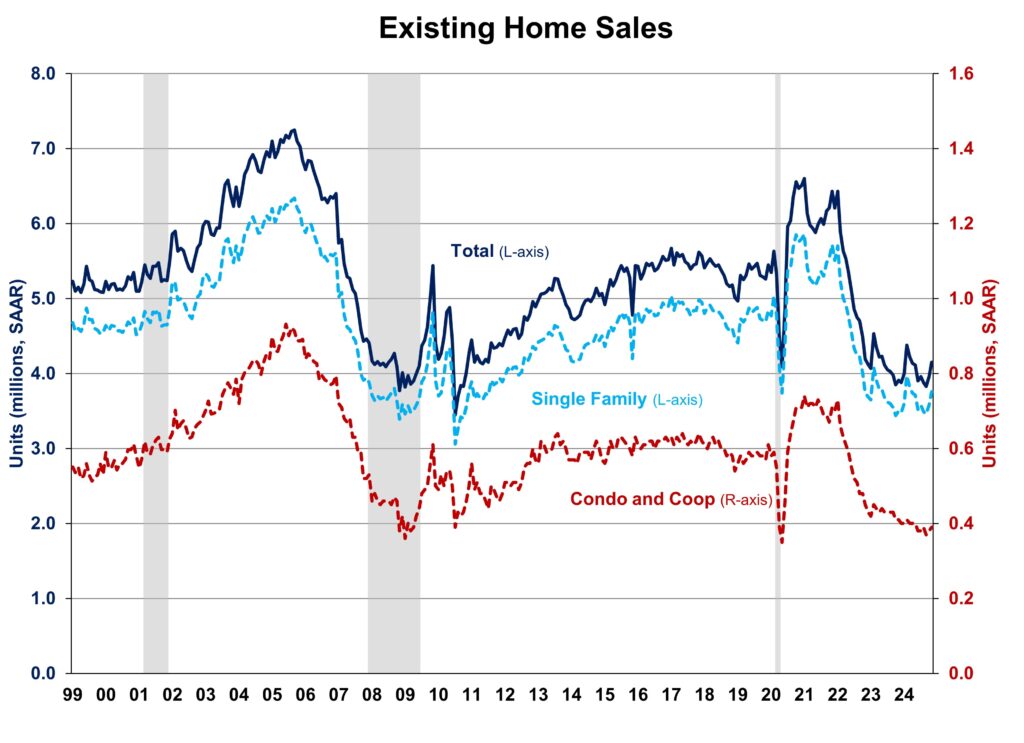

Complete current dwelling gross sales, together with single-family houses, townhomes, condominiums, and co-ops, rose 4.8% to a seasonally adjusted annual charge of 4.15 million in November, the best stage since March 2024. On a year-over-year foundation, gross sales have been 6.1% increased than a 12 months in the past, the biggest annual acquire since June 2021.

The primary-time purchaser share rose to 30% in November, up from 27% in October however down from 31% in November 2023.

The prevailing dwelling stock stage fell from 1.37 million in October to 1.33 million items in November however is up 17.7% from a 12 months in the past. On the present gross sales charge, November unsold stock sits at a 3.8-months provide, down from 4.2-months final month however up 3.5-months a 12 months in the past. This stock stage stays low in comparison with balanced market situations (4.5 to six months’ provide) and illustrates the long-run want for extra dwelling building.

Houses stayed available on the market for a mean of 32 days in November, up from 29 days in October and 25 days in November 2023.

The November all-cash gross sales share was 25% of transactions, down from 27% skilled in each October 2024 and November 2023. All-cash patrons are much less affected by modifications in rates of interest.

The November median gross sales value of all current houses was $406,100, up 4.7% from final 12 months. This marked the seventeenth consecutive month of year-over-year will increase. The median condominium/co-op value in November was up 2.8% from a 12 months in the past at $359,800. This charge of value progress will gradual as stock will increase.

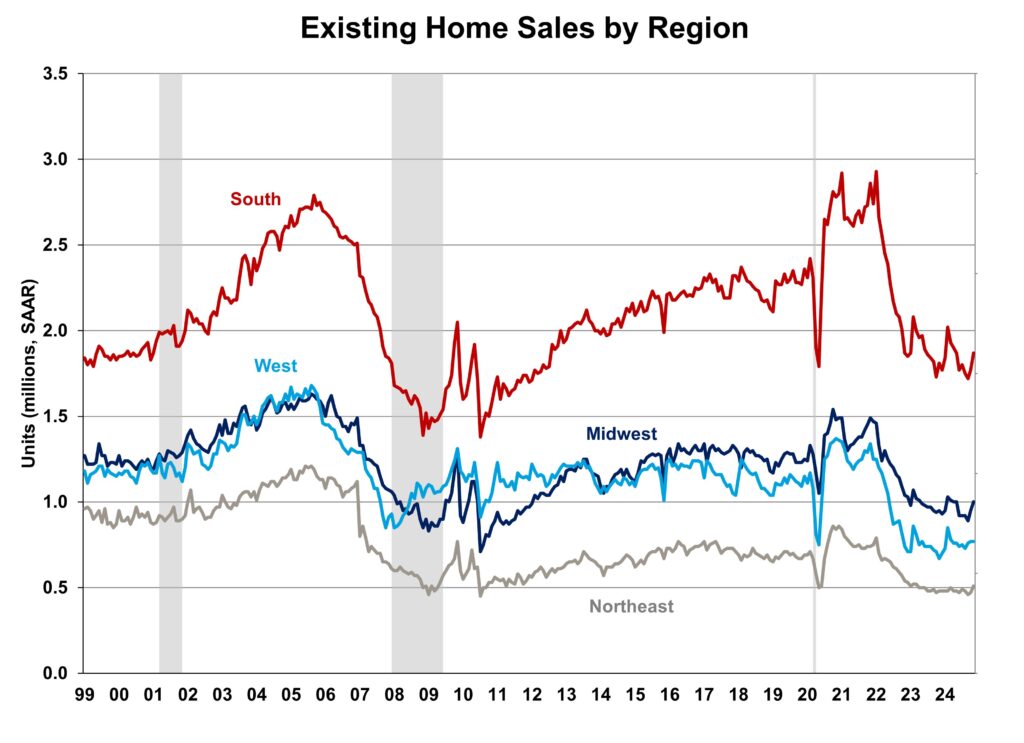

Geographically, three of 4 areas noticed a rise in current dwelling gross sales in November, starting from 5.3% within the Midwest to eight.5% within the Northeast. Gross sales within the West stayed unchanged in November. On a year-over-year foundation, gross sales grew in all 4 areas, starting from 3.3% within the South to 14.9% within the West.

The Pending Dwelling Gross sales Index (PHSI) is a forward-looking indicator based mostly on signed contracts. The PHSI rose from 75.9 to 77.4 in October on account of improved stock. On a year-over-year foundation, pending gross sales have been 5.4% increased than a 12 months in the past per Nationwide Affiliation of Realtors information.

Uncover extra from Eye On Housing

Subscribe to get the most recent posts despatched to your electronic mail.