Supply: The School Investor

Public Service Mortgage Forgiveness (PSLF) is the perfect pupil mortgage forgiveness program presently accessible.

Only a couple years in the past, the primary spherical of public servants grew to become eligible for Public Service Mortgage Forgiveness. These early recipients had been the primary to have their Direct pupil loans forgiven with the PSLF program.

With rising consciousness of this system, and an elevated variety of income-driven compensation plans, increasingly persons are changing into eligible for mortgage forgiveness. Are you an individual who may turn into eligible for mortgage forgiveness? Discover out in our final information to Public Service pupil mortgage forgiveness.

What Is Public Service Mortgage Forgiveness?

Public Service Mortgage Forgiveness (PSLF) is a federal program that permits mortgage forgiveness for certified workers who work full-time for a wide range of employers. Full-time work requires working at the very least 30 hours per week.

After 120 on-time funds (10 years) of federal pupil loans (extra on that beneath), certified candidates can have the rest of their federal loans forgiven.

Certified employers of public service jobs embrace:

- The federal government (together with army, legislation enforcement, faculties. and universities)

- Tax-exempt not-for-profit 501(c)(3) corporations; together with tax-exempt hospitals, tax-exempt charitable organizations, tax-exempt academic establishments, and many others. (It’s necessary to notice that for those who’re a member of clergy or your work is spiritual in nature, you might not obtain exemption. To qualify it’s essential to spend at the very least 30 hours per week on work that doesn’t should do with proselytizing, conducting worship providers, or offering spiritual instruction.)

- Peace Corps or AmeriCorps

- Different non-profit organizations that present one of many following providers:

- Emergency administration

- Army service

- Public security

- Regulation enforcement

- Public curiosity legislation providers

- Early childhood training (together with licensed or regulated healthcare, Head Begin, and state-funded prekindergarten)

- Public service for people with disabilities and the aged

- Public well being (together with nurses, nurse practitioners, nurses in a medical setting, and full-time professionals engaged in healthcare practitioner occupations and healthcare help occupations, as such phrases are outlined by the Bureau of Labor Statistics)

- Public training

- Public library providers

- College library or different school-based providers

Advocacy teams, political teams, and labor unions will not be certified employers.

How Does the 120-Fee System Work?

To truly get mortgage forgiveness, you must make 120 “certified” funds in your pupil loans. Certified funds have to fulfill the next standards:

- You had been employed full-time by a certified employer

- Your loans weren’t in deferment, forbearance, or default

- The fee was made after October 1, 2007

- Made on time and in full (paid the total installment quantity – not simply what your invoice says – inside 15 days of the due date). As of August 2020, prepayments are allowed, however you possibly can see our full article on Pay Forward Standing and PSLF and why we nonetheless warning in opposition to this.

- Below a professional compensation plan (Some of the necessary issues to know is the requirement of being below a professional compensation plan. Certified compensation plans embrace any income-driven compensation plans – IBR, PAYE, REPAYE/SAVE, ICR. These embrace month-to-month funds of $0 which may accrue for those who’re incomes a wage beneath the poverty line. Funds made below the Customary Compensation Plan for Direct Consolidation Loans would qualify for PSLF functions provided that the utmost compensation interval was set at 10 years. When you have Direct Consolidation Loans, make sure to mix the mortgage with an income-driven compensation plan.)

The 120 funds don’t should be consecutive. So for those who take just a few years off of public service work, you possibly can come again in the place you began.

In the event you do make a big lump-sum prepayment, that fee will probably depend as qualifying funds (given employment certification is on file and all different eligibility circumstances are met) below the PSLF Program for as much as 12 months or till the following time their income-driven compensation plan is due for certification, whichever comes first. We nonetheless do not advise this, but it surely does assist with the pay-ahead standing difficulty. See the announcement right here.

Usually, for those who consolidate your loans, the clock on the 120 funds restarts. That’s proper. The clock on the 120 funds resets once you consolidate your pupil loans. The very best time to consolidate your pupil loans is at the start of the mortgage forgiveness course of. The second greatest time is by no means.

Some ideas for making essentially the most out of PSLF:

- Don’t make bigger funds than are needed.

- Don’t make multiple fee monthly.

- Get on an income-driven compensation plan immediately.

- If you wish to consolidate your loans, achieve this as quickly as you graduate from school.

When Does the Clock Begin for My 120 Mortgage Funds?

You possibly can start making qualifying PSLF funds as soon as the in-school deferment and charm interval in your loans ends. If you wish to begin making funds immediately, consolidate your loans and start compensation instantly.

Warning: Consolidating loans can “reset the clock” on PSLF! Keep in mind, consolidating your federal loans resets the clock on Public Service Mortgage Forgiveness. Don’t consolidate for those who’ve already made eligible funds below PSLF.

Word: The waiver to consolidate outdated FFEL or Perkins loans has expired.

How Do I Apply for Public Service Mortgage Forgiveness?

One of the simplest ways to use for Public Service Mortgage Forgiveness in the present day is to make use of the PSLF Assist Device. This on-line software will assist you to fill out every little thing you want and be sure that you do not miss something. Nonetheless, once you’re carried out with the instrument, it should merely make you print the PDF PSLF Kind. You should take this type to your employer for signature after which submit by mail, fax, or safe add to your mortgage servicer’s web site.

You’ll need to full and submit the Software and Employment Certification type for Public Service Mortgage Forgiveness yearly or once you change employers.

How To Fill Out The PSLF Kind

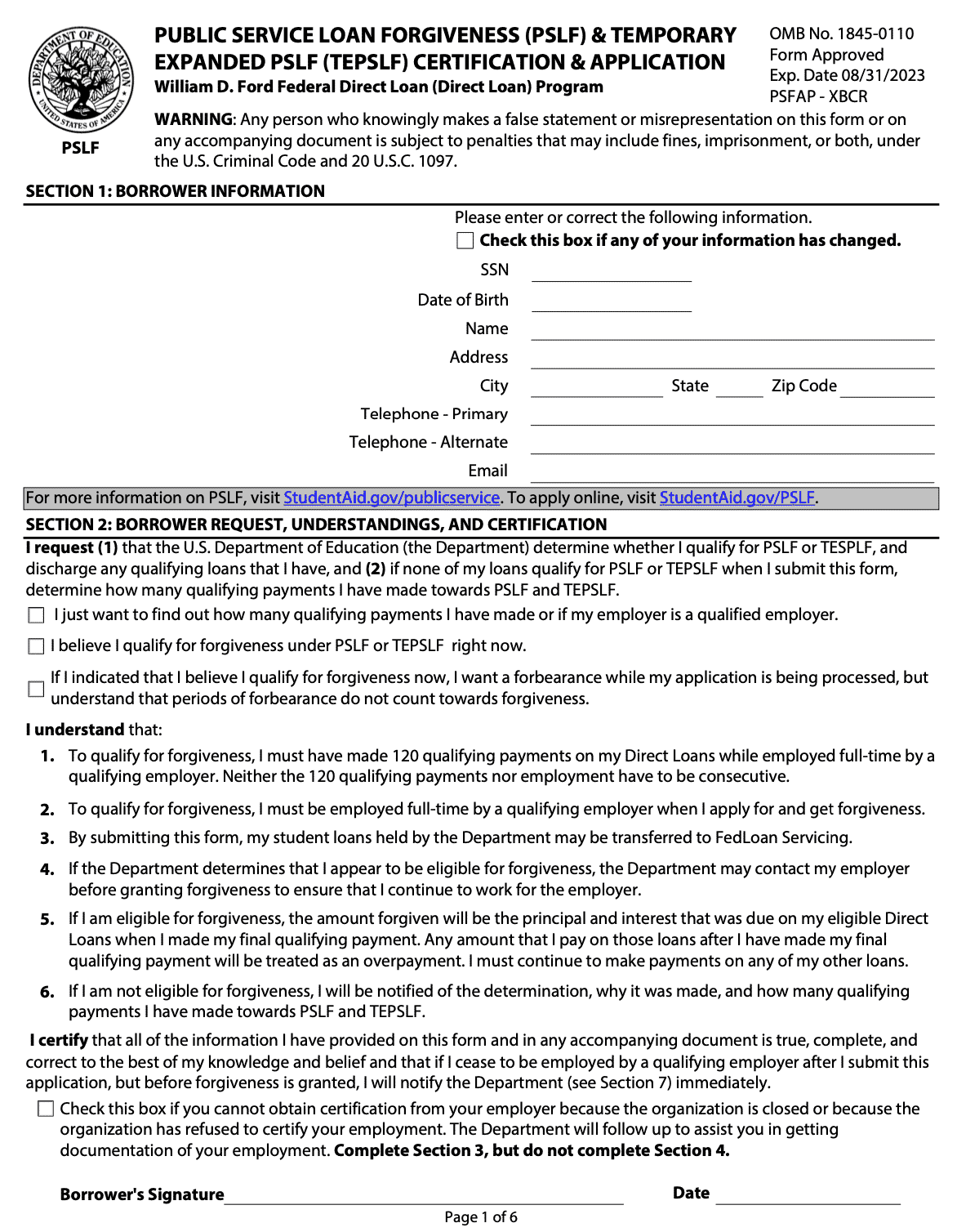

Filling out the PSLF type is straightforward – it is principally like a job software. On Web page 1 you merely fill out your private data (title, SSN, date of start, handle, and many others.). You additionally verify the field for the explanation you are filling out the shape.

You may have three decisions:

- I need to learn the way many qualifying funds I’ve

- I consider I qualify for mortgage forgiveness below PSLF or TEPSLF proper now

- If I consider I qualify proper now, I desire a forbearance whereas my software is being processed

If you realize you are not at 120 funds but, merely verify field 1 to certify your employment.

In the event you’re at 120 funds, you possibly can choose field 2 (and three for those who want). Three is dangerous for those who’re shut or uncertain. Nonetheless, for those who’re past 120 funds, you’re going to get a refund for any extra funds as soon as your software is processed.

PSLF Kind Web page 1. Supply: Division of Training

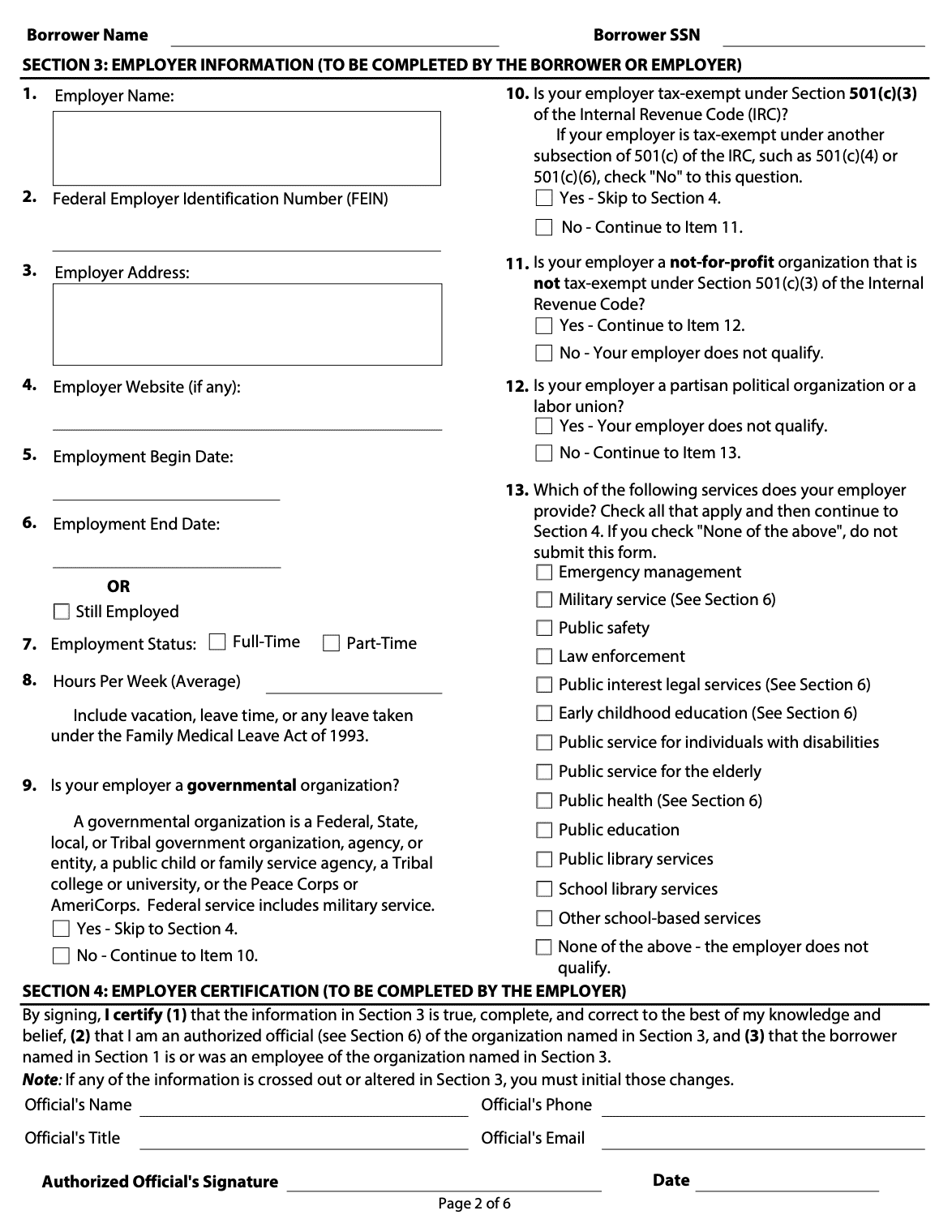

Web page 2 of the PSLF Kind merely asks for all of your employer data. Employer title, handle, Federal Identification Quantity (you will discover this in your W2), web site, and employment dates. You additionally choose what kind of employer that is.

On the backside of the shape, you want your employer to fill it out. This may very well be your boss, the proprietor, or HR.

PSLF Kind Web page 2. Supply: Division of Training

After You Full The Kind

After you full the shape, you possibly can both print the shape and get a moist ink signature out of your employer, OR in case you are utilizing the PSLF Assist Device, you possibly can enter your employer’s e-mail handle and they’re going to ship the shape for an digital signature.

In the event you decide to get a moist ink signature out of your employer, then mail, fax, or safe add the shape.

You’ll mail the shape to:

U.S. Division of Training

MOEHLA

633 Spirit Drive

Chesterfield, MO 63005-1243

After you submit this type, MOHELA will turn into your mortgage servicer. At this level, MOHELA will overview your mortgage fee historical past to find out what number of certified funds you made. In the event you had a number of employers, make sure to submit a number of Employment Certification varieties.

Annually, it is best to proceed to submit your Employment Certification type. However you must also save IRS W-2 paperwork and different paperwork that may show you had been a full-time worker. It will make it a lot simpler for MOHELA to trace your funds (and also you’ll keep away from main hassles as soon as your 120 funds are full).

MOHELA permits you to verify on the variety of funds you’ve made by its account entry space.

When you’ve reached 120 funds (congratulations!), you possibly can apply for pupil mortgage forgiveness.

You possibly can merely add the shape to https://www.mohela.com/DL/safe/borrower/UploadFile.aspx or mail it in to:

MOEHLA

633 Spirit Drive

Chesterfield, MO 63005-1243

MOHELA will let you realize that your software is accredited, and also you’ll obtain notifications of mortgage balances of zero!

Word: Fedloan Servicing was beforehand the mortgage servicer who dealt with PSLF. Nonetheless, since they’ll now not be a mortgage servicer for Federal loans, MOHELA is taking up the PSLF eligible loans.

Which Loans Are Eligible for PSLF?

Non-public pupil loans will not be eligible for mortgage forgiveness. PSLF is barely a program for pupil loans of the Federal Direct Loans kind. These embrace:

- Direct Sponsored Loans

- Direct Unsubsidized Loans

- Direct PLUS Loans

- Direct Consolidation Loans (Editor’s Word: See the warning about this as beforehand written on this article.)

If the mortgage isn’t on the record above, it’s not eligible for mortgage forgiveness.

Vital Word Concerning FFEL and Perkins Loans: President Biden introduced that there shall be a restricted waiver for prior funds that had been made below FFEL or Perkins Loans. This waiver has now expired. Study extra right here.

Are Direct Consolidation Loans Actually Eligible?

Direct Consolidation Loans are eligible for mortgage forgiveness, however with a number of necessary caveats.

First, for those who and your partner consolidated onto a Direct Consolidation Mortgage, and solely one in all you met the employment necessities, the portion of the steadiness attributable to the certified worker is forgiven. The remainder will not be.

Moreover, joint consolidation loans from the Federal Household Training Mortgage (FFEL) Program can’t be forgiven. Study extra about what to do with joint spousal consolidation loans right here.

Lastly, any time you consolidate your federal loans, you restart the 120-payment requirement.

Are FFEL Loans Forgivable?

Usually, no. However President Biden introduced a waiver that previous funds that had been made below FFEL or Perkins Loans will depend for PSLF. Nonetheless, to qualify, it’s essential to consolidate your mortgage into a brand new Direct pupil mortgage AND have employment certifications on file for these previous funds. Study extra right here.

Up till June 2010, Federal Household Training Mortgage (FFEL) Program loans had been one of many largest federal loans issued to pupil debtors. Sadly, these loans weren’t issued by the U.S. Division of Training, and don’t qualify for PSLF.

You would consolidate these loans right into a Direct Consolidation Mortgage, however that can reset the clock in your PSLF.

Word: In the event you consolidate your FFEL mortgage previous to October 31, 2022, you possibly can apply for PSLF and eligible funds will depend.

Is Mortgage Forgiveness Taxable?

Top-of-the-line perks of PSLF is that the mortgage forgiveness will not be taxable. Irrespective of how a lot curiosity you’ve accrued, the total steadiness of the mortgage is forgiven, and the quantity forgiven isn’t taxed.

Nonetheless, some states might levy a tax on forgiven pupil loans (particularly Mississippi). See this information: State Taxes and Pupil Mortgage Forgiveness.

What Occurs to PSLF If I Default on My Loans?

In the event you’re on an income-driven compensation plan, it is best to by no means default in your loans. Paying your pupil loans must be one in all your highest monetary priorities.

That mentioned, any debt in default will not be counted as a qualifying fee in your mortgage. That features any time you spend “rehabbing” the mortgage to present standing.

Maintain your pupil loans out of default by prioritizing compensation. Keep in mind, in case your earnings adjusts downward (say you lose your job), you possibly can reset your compensation plan in the course of the yr.

Will Public Service Mortgage Forgiveness Nonetheless Be Round?

PSLF is among the favourite punching luggage for Congress. An act of Congress may remove this system in the present day. That mentioned, it’s extra probably that the foundations for certified employment shall be narrowed relatively than this system being fully eradicated.

In the event you’re very apprehensive about it, you might need to proceed making the usual funds in your pupil loans. Simply bear in mind, all the potential modifications are simply proposals. Take a look at the total record of Trump Pupil Mortgage Forgiveness Proposals right here.

How To Attraction Your PSLF Fee Depend

Over the previous few years, debtors have complained that their PSLF qualifying fee depend has not been correct – particularly lacking funds. In the event you’re lacking funds, there are two issues it is best to learn about interesting your PSLF fee depend.

In the event you consider there’s an error, you possibly can manually enchantment your PSLF fee depend. Here is how:

- Debtors can go to the PSLF Reconsideration Request Kind to submit a reconsideration request.

- Debtors will login with their FSA ID.

- You’ll then have to decide on between an employer or a fee reconsideration request and describe in as a lot element as attainable why your PSLF eligibility standing must be reconsidered.

- Add supporting documentation, corresponding to proof of funds and proof of qualifying employment, in addition to any correspondence from FedLoan Servicing.

Momentary Expanded PSLF (TEPSLF)

In 2018, Congress created Momentary Expanded Public Service Mortgage Forgiveness. This program is designed to assist debtors who had been on the fallacious compensation plan, however in any other case would have been eligible to have their loans forgiven below PSLF.

This can be a difficult exception to this system, and it solely applies to sure debtors on the fallacious compensation plan (not fallacious mortgage kind of disqualified employment).

We break down the total necessities and the way it works right here: Momentary Expended PSLF (TEPSLF)

Ultimate Ideas

PSLF is a good program, but it surely does require you comply with very strict guidelines to get your loans forgiven.

In the event you’re uncertain about what to do or find out how to fill out the certification varieties, take a look at Chipper and see if it may possibly assist you to higher observe your PSLF eligibility.

Editor’s Word: This text has been up to date to mirror mortgage servicer modifications, date modifications, and different up to date data. There’s presently a processing pause on PSLF because of the modifications from MOHELA to inside Division of Training techniques. We’ll replace this when now we have extra data.