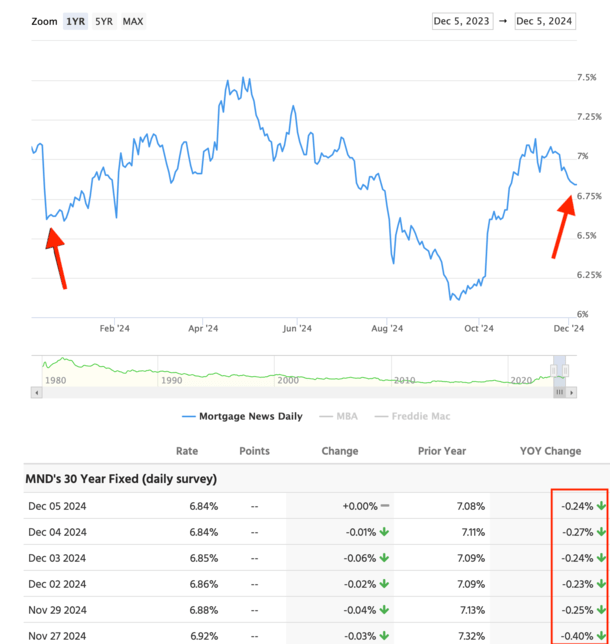

It’s been a wild experience for mortgage charges this 12 months. The 30-year mounted started 2024 at round 6.625% and is presently not removed from these ranges.

Regardless of that, charges have been as little as 6% and as excessive as 7.50%. So there was fairly a variety over the previous 50 weeks or so.

Charges rallied final December after the Fed revealed it was able to pivot and start loosening financial coverage.

However as at all times, they ebbed and flowed alongside the way in which, as a substitute of merely falling decrease and decrease, with the previous couple months fairly the rollercoaster increased.

Nevertheless, we stay in a falling price setting, even when charges aren’t presently at their 2024 lows. Enable me to clarify.

Mortgage Charges Are Higher Than Their Yr-In the past Ranges

Many issues, together with house costs and mortgage charges, are measured each month-to-month and year-over-year.

The latter can provide you an even bigger image of the place one thing is trending, whether or not it’s house costs or mortgage charges.

For instance, house costs would possibly fall month-to-month, however nonetheless register year-over-year positive factors due to stronger months alongside the way in which.

With regards to mortgage charges, I’ve argued since mid-September that we remained in a falling price setting.

Why did I’ve to? As a result of charges on the 30-year mounted climbed from about 6% to 7% within the span of lower than two months.

This had many fearing for the worst. That the latest enchancment in charges was one other head faux. And a return to eight% or increased was imminent.

In any case, we’d seen this film earlier than, as lately as spring of this 12 months, when the 30-year mounted climbed from 6.5% to 7.5%.

However my argument has at all times been that we’ve seen decrease highs. So first it was 8%, then 7.5%, and most lately 7%.

As well as, mortgage charges have been besting their year-ago ranges, displaying a longer-term development versus some short-lived noise.

However They’ll Must Preserve Dropping Due to a Latest Uptick

Simply to summarize the previous couple months, the Fed minimize charges in mid-September, which led to a bit promote the information bounce in charges.

Merely put, the minimize was baked in as evidenced by charges falling practically two proportion factors from October 2023.

Then we obtained a one-off scorching jobs report that additional propelled mortgage charges increased, adopted by a presidential election.

As soon as it grew to become clear that Trump was the frontrunner to win, charges moved even increased nonetheless, as his insurance policies like tariffs are anticipated to be inflationary.

However ultimately that massive run up in charges ran out of steam and so they appeared to get again on their downward monitor.

Finally, the financial information is what issues and it continues to indicate cooling inflation and a few concern about rising unemployment.

That has pushed mortgage charges again from 7.125% to round 6.75% once more. The massive query now’s if they will preserve going decrease.

As proven within the chart above from MND, the 30-year mounted plummeted in early December 2023 when the Fed implied it was finished mountaineering and able to minimize charges in 2024.

That required the 30-year mounted to be sub-6.82% to beat its year-ago ranges, which it barely completed thanks to a different smooth labor report this previous Friday.

It now faces a good greater take a look at because the 30-year mounted was 6.65% in mid-December 2023, which means we’ll must see charges enhance additional over the following week to match/beat these ranges.

In fact, it doesn’t should be good.

Can Mortgage Charges Get Again to Sub-6% By February?

Whereas charges definitely appear to be trending in the proper path after the mud settled from the election, they’ve nonetheless set to work to do.

With the intention to proceed to stay under year-ago ranges, they’ll must fall one other 10 foundation factors over the following week, which appears cheap.

However to succeed in decrease highs in 2025, they’ll must preserve displaying enchancment and get into the 5s, contemplating we noticed a price of 6.125% earlier this 12 months.

They’ve time to do this, however mortgage charges are typically lowest in winter, so maybe it’ll occur sooner reasonably than later.

The final time the 30-year mounted was sub-6% was really on February 2nd, 2023, when it hit 5.99%, per MND. It was very short-lived, and charges jumped to 7% that very same March.

Nevertheless, it’s potential charges might proceed to float that method into 2025, divvied up between some enhancements this month and in January.

And it’s probably not an enormous ask for those who think about that the 30-year mounted was 6.125% in mid-September. Additionally observe that charges are likely to fall for a number of years after a Fed pivot.

Conversely, the most important threat to mortgage charges climbing within the short-term, aside from any robust financial information reminiscent of increased inflation or decrease unemployment, can be inauguration-related noise.

There’s been a relative calm of late, however with that date steadily approaching, the federal government spending and inflation rhetoric might ratchet up once more in early 2025.

Nonetheless, it wouldn’t shock me to see mortgage charges proceed to development decrease in 2025 and stay in a falling price setting.