That is an election 12 months within the UK and until one thing dramatically modifications, the Labour Social gathering can be in energy for the subsequent time period of Parliament and should handle a poly disaster that they’ll inherit from 40 or extra years of neoliberalism. Word, I don’t confine the antecedents to the Tory interval of workplace since 2010 as a result of the decline began with James Callaghan’s Labour authorities within the Nineteen Seventies after which simply obtained worse throughout successive durations of Labour and Tory rule. Throughout that lengthy interval, there was no scarcity of economists and public officers predicting that the monetary markets would quickly reap chaos on account of the general public debt ranges being ‘too excessive’ (no matter which means). Probably the most vital chaos got here in 1992 when Britain was pressured out of the European change price system, which it ought to by no means have joined within the first place. Whereas all these economists are actually pressuring the possible subsequent British authorities to drag again on their guarantees to ‘assuage’ the monetary markets, there’s not even a scintilla of proof to help their predictions of doom. And the Labour social gathering leaders are too silly to grasp that.

For brand spanking new readers, we should always all the time begin by noting that each one this dialogue is fairly pointless on condition that the UK authorities by no means must concern any debt at any maturity to be able to spend the foreign money that it alone points and spends by way of laptop keystrokes.

The truth that the UK authorities continues to take action is a hangover from the Put up World Conflict 2 mounted change price system, which successfully resulted in August 1971, when President Nixon cancelled the gold convertibility for US greenback holdings.

After all, on condition that the general public are largely unaware of what debt is, how it’s issued and the implications of issuing it, politicians use it as a robust leverage software to affect public coverage.

They’ll all the time keep away from spending by telling the general public that they don’t wish to ‘improve the taxpayers’ debt burden’ or oppositions can accuse a authorities of irresponsible profligacy for ‘operating up the debt mountain’.

Neither assertion/accusation has the remotest validity when it comes to financial dynamics however works as a robust political weapon.

If the general public understood what the debt was all about then the weapon would change into irrelevant when it comes to influencing public coverage decisions.

I’ve written about this in lots of weblog posts however this one covers a lot of the points and recounts an attention-grabbing Australian story I used to be concerned in additional than 20 years in the past, which actually gave the sport away – Market contributors want public debt (June 23, 2010).

The UK Guardian article over the weekend (January 24, 2024) – Be careful, Rachel Reeves: the outdated guard is ganging up in your borrowing ambitions – studies about how onerous it is going to be for the Labour authorities to interrupt out of the cycle it discovered itself in from the Nineteen Seventies when it first began to articulate the ‘appease the monetary markets’ narrative.

The following British authorities has to urgently escape of the ‘sound finance’ entice as a result of the challenges going through it are immense.

There’s decayed infrastructure to be mounted and expanded.

Privatisations which have gone badly improper in important companies should be reversed.

Native governments need to be revitalised with additional funding.

The hospital system and associated NHS wants vital injections of capital after years of outsourcing and privatising attrition.

Then there’s the local weather concern – oh that!

The issue is that the Labour Social gathering thinks it’s intelligent to lie and declare they will make investments closely in all types of issues but, on the similar, time meet some ridiculous self-imposed ‘fiscal guidelines’ that extremely constrain what they will do.

I’ve written extensively concerning the fiscal guidelines that the Labour Social gathering dropped at the final basic election – the so-called Fiscal Credibility Rule.

This weblog publish incorporates various hyperlinks that sequence my interactions with British economists on the subject – The British Labour Fiscal Credibility rule – some additional closing feedback (October 23, 2018).

You can even discover a few of them through the use of this – Search Hyperlink.

The so-called ‘Fiscal Credibility Rule’ that the Labour Social gathering took to the final election was a traditional submission to the neoliberal pressures and amounted to a give up by the Labour Social gathering to the conservatives and company varieties who use authorities debt as a type of company welfare however need governments to chop any revenue help to the deprived.

On the time, I used to be considerably vilified by the economists who had framed the rule for the Labour Social gathering as a result of I uncovered, not solely its ideological origins, but in addition demonstrated that it was internally inconsistent with proposed Labour coverage and will surely fail to be met.

Whereas denial reigned supreme, I additionally famous in the previous couple of weeks of the marketing campaign, the Social gathering altered the rule to attempt to cut back the inconsistencies that I had identified.

These modifications had been made with none acknowledgment that their arguments in supporting the primary model of the Rule had been faulty.

Anyway, the brand new shadow chancellor, Rachel Reeves has not appeared to study something from that interval and commonly sprouts forth about their new rule, which I’ve not but appear formally specified however appears to resemble the outdated rule.

The UK Guardian article (cited above) confirms that the institution economists snd monetary market varieties are already operating the ‘debt mountain’ narrative and that Reeves is steadily watering down the ambitions of a brand new Labour govenrment ought to they be elected.

A number of weeks in the past, the Labour Chief informed the British folks throughout a radio interview that the earlier guarantees to speculate £28 billion per 12 months on local weather change funding initiatives was now simply an ‘ambition’ as a result of the “fiscal guidelines come first”, referring to the dedication to make sure that public debt to GDP ratio falls within the first 5 years of taking workplace (Supply).

The response was clear – their promise to generate electrical energy by 2030 with out using fossil fules could be very onerous to maintain with out the funding now.

The so-called ‘Inexperienced Prosperity Plan’ requires huge funding now from authorities

So the ‘fiscal guidelines’ first and the older ‘struggle inflation first’ are a continuation of the identical neoliberal nonsense that my career infests the general public debate with.

The UK Guardian article concluded that:

Such is the load of argument towards Reeves that Labour has scaled down its ambitions, and the funding plan will solely cut back, fairly than reverse, the dramatic fall in public funding as a proportion of nationwide revenue mapped out by the present administration over the subsequent 5 years.

Unhealthy luck Britain.

A pox on either side of politics.

The UK Guardian article, after all, whereas reporting the assaults of economists on the political class over debt, additionally perpetuates the identical logic that these economists use.

It claims that within the lead as much as the 2010 election an analogous assault on Labour fiscal coverage was made however that:

… there was a transparent case for borrowing at traditionally low rates of interest to put money into Britain’s infrastructure and its training, well being and welfare methods to boost productiveness and nationwide revenue.

That is the ‘deficit dove’ argument that if rates of interest are low, the federal government can make investments however not in any other case (as now).

The purpose this avoids (or doesn’t know) is that the central financial institution, part of authorities, can management bond yields at any time when it desires to by merely shopping for all of the debt that’s issued.

Furthermore, the federal government can spend past its tax income with out issuing debt any time it desires.

That must be the progressive narrative fairly than conceding that typically it’s okay to put money into public infrastructure that may advance public profit however different occasions it isn’t.

A significant intervention within the public debate got here earlier this month, when the boss of the Debt Administration Workplace within the UK (which points the debt for presidency), was reported within the Monetary Occasions (January 4, 2024) – UK debt chief warns extreme borrowing dangers investor backlash – as claiming the federal government must be “cautious of a backlash in monetary markets” ought to it borrow an excessive amount of.

He claimed that “the job of issuing bonds was getting tougher and traders may act as a restraining influencing on fiscal coverage”.

The latter level is clearly only a lie – the federal government can ignore the ‘traders’ if it desires to by turning off the company welfare machine that’s the bond issuing charity scheme.

However what concerning the first level – that it’s getting tougher to concern bonds?

Right here is a few information on the bid-to-cover ratios.

I wrote about these ratios in these weblog posts amongst others:

1. D for debt bomb; D for drivel (July 13, 2009).

2. Bid-to-cover ratios and MMT (March 27, 2019).

The bid-to-cover ratio is the ratio of the whole quantity of bids to the quantity on provide at a gilt public sale or a Treasury invoice tender.

So whether it is precisely 1, then there are the identical variety of bids (in foreign money phrases) as there’s debt up for public sale.

Under 1 – which is known as an ‘uncovered public sale’ – there are an absence of bids and the federal government both has to promote much less in that public sale or the central financial institution will simply hoover up the shortfall.

No drama both manner.

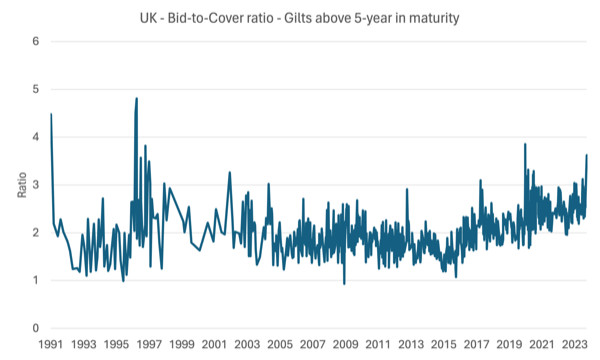

The next graphs present the bid-to-cover ratio for all British Treasury Gilts from the public sale on April 24, 1991 to the newest public sale on January 10, 2024, excluding the Index-linked Treasury Gilts.

Excluding the index-linked Treasury Gilts truly makes it tougher to show my level.

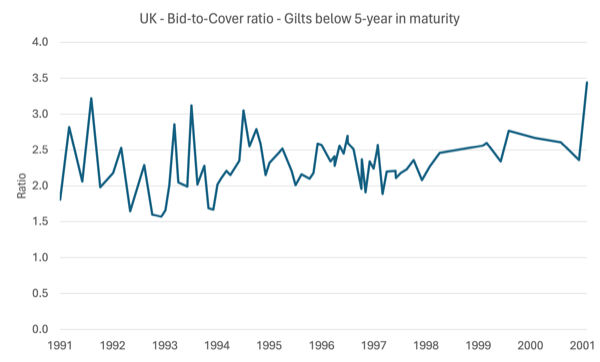

I divided the info into short-run debt issued (lower than 5 years in maturity) and the longer-term gilts (above 5 years in maturity).

91 per cent of the non-index linked Gilts issued had been for durations longer than 5 years.

The primary graph is the longer-term debt and the second graph the remainder.

For the longer-term points, the bid-to-cover ratio fell beneath 1 on two events:

1. September 27, 1995 for a 7½% Treasury Inventory 2006 concern – ratio was 0.99.

This Financial institution of England report – The gilt-edged market: developments in 1995 – helps us perceive what occurred in that interval.

Previous to September 1995, long-term yields on British authorities gilts had been falling after the monetary market turmoil in European foreign money markets over the Summer season of 1992, which culminated for Britain with Black Wednesday (September 16, 1992) and its exit from the European change system.

We all know that there have been “political uncertainties in the UK and expectations of rate of interest reductions in america” over the 1995 Northern Summer season.

Barings Financial institution had collapsed in February of that 12 months.

Gilt costs had been rising over that interval because the “home political components turned much less essential” and the September gilt public sale ended uncovered solely to get well strongly in October (bid-to-cover ratio of two.0).

The Financial institution of England notes that:

The September public sale of £3 billion of a brand new ten-year benchmark for 1996 was the primary gilt public sale to be uncovered (albeit solely very marginally so), and the tail of seven foundation factors was the longest then recorded. However the market turbulence through which the public sale came about, it was disappointing that ‘when issued’ buying and selling within the run-up to the public sale, which is generally seen as an efficient mechanism for worth discovery, did not discover a stage at which the public sale would clear.

However nothing to fret about.

2. March 25, 2009 for a 4¼% Treasury Gilt 2049 concern – ratio was 0.93.

This public sale was held within the depths of the GFC and the federal government was making an attempt to concern 30-year gilts in a really unsure market.

This public sale was adopted by the April auctions had been the long-term debt points had bid-to-cover ratios of two.23, 1.59, 1.82 and a couple of.11 for varied maturities.

The Debt Administration Workplace, which took over duty for the administration of presidency bonds in April 1998 from the Financial institution of England reported in its – Debt and reserves administration report 2009-10 – that:

In conclusion, as measured by the bid-to-cover and public sale tail, gilt public sale efficiency in 2008-09 has remained robust general.

They attributed the uncovered public sale on March 25, 2009 to “risky gilt market circumstances”.

This was a time that the Financial institution of England started its asset buying program (QE), which raised uncertainties.

However general a blip.

General, the common bid-to-cover ratio for the debt over 5-years was 2.09.

Nonetheless, in recent times (because the begin of 2022) the ratio has averaged 2.53.

Since 2023, the common has been 2.62 and the newest public sale (the primary) for 2024 it was 3.62 on 20-year gilts.

It’s onerous to search out any justification for the boss of the DMO’s conclusion that “the job of issuing bonds was getting tougher”.

The bid-to-cover ratios for the shorter-term debt are clearly all the time nicely above 1.50.

What all which means is the ‘traders’ within the monetary markets can’t get sufficient of the first gilts issued by the British authorities to match (not finance) their fiscal deficits.

The company welfare is in excessive demand.

Conclusion

The newest doom leverage merchandise used – in a long-line – is the so referred to as “ill-fated ‘mini’ Funds of September 2022 which despatched the gilt market into meltdown”.

That could be a unusual conclusion as a result of the bid-to-cover ratios averaged 2.25 by means of September and October final 12 months even when yields rose considerably.

My evaluation of that interval was that the monetary markets, all the time in search of to bluff the federal government, realised they may make threats to cease shopping for the debt as a result of the federal government resolve was so weak.

If the monetary markets can dominate, why has the Financial institution of Japan been in a position to maintain agency over three many years to its much-criticised coverage, which regularly thwarts the short-sellers.

That’s sufficient for at the moment!

(c) Copyright 2024 William Mitchell. All Rights Reserved.