For the uninitiated, Fave has been round since 2017 and gives a possibility so that you can earn each bank card rewards and cashback each time you pay.

However when you didn’t already know, Fave is extra than simply QR code funds.

I’ve been utilizing this to triple dip my rewards i.e.

- Earn miles on bank card – even for when the service provider doesn’t settle for Mastercard or Visa

- Obtain immediate cashback – to offset my subsequent transaction

- Get further reductions and financial savings by means of Fave Offers, eCards and Reward Playing cards

Immediately, I’ll allow you to in on this hack and share with you the other ways you should utilize Fave to avoid wasting and earn extra rewards.

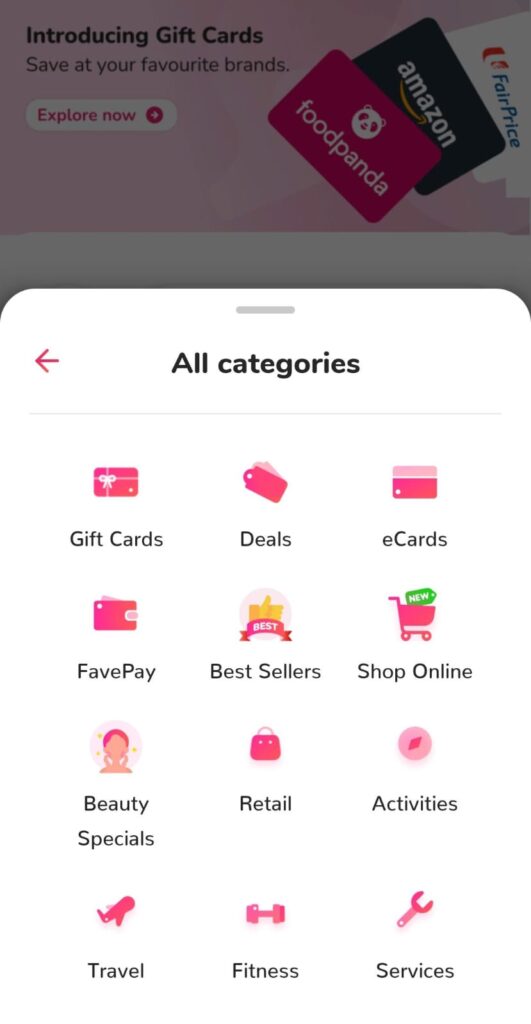

FavePay vs. Offers vs. eCards vs. Reward Playing cards

Your entire Fave ecosystem has grown past simply QR codes and offers.

Right here’s an outline of how you should utilize Fave as we speak:

- Make in-person QR code funds with FavePay for immediate cashback and bank card rewards

- Search for unique Fave Offers for on-line or bodily retailer redemption

- Buy discounted eCards to scale back your invoice

- Purchase Fave Reward Playing cards for your self or your folks, for use straight with the respective model(s)

Right here’s how one can take advantage of out of Fave.

Tip 1: Make QR code funds with FavePay for immediate cashback and bank card rewards

Every time I see folks scan the SG QR code to pay for his or her transaction, I at all times marvel in the event that they know they’ll choose FavePay as an alternative — because it comes with higher advantages.

The SGQR code means that you can use quite a lot of cost choices – DBS PayLah, OCBC, UOB TMRW, Seize, Nets, and so on. However not all cost strategies offers you bank card rewards, particularly because you’re paying by way of debit, or Seize which counts as an e-wallet top-up (and that’s sometimes excluded from miles or cashback).

Psst, do you know? Should you use DBS PayLah, GooglePay, UOB TMRW or Singtel Sprint, you can even get service provider cashback if the service provider accepts Fave! However you’ll not earn miles that means.

I wager these folks most likely don’t know that in the event that they pay by means of Fave as an alternative, they’ll earn their candy bank card factors. They could not even know the Fave app exists.

That’s as a result of while you hyperlink your most well-liked bank card(s) with FavePay, it means that you can convert an offline spend into a web based expense that may concurrently earn your bank card rewards.

Be aware: Paying by means of the Fave will code the transaction as a web based one, whereas retaining the underlying service provider class code (MCC). Thus, you’ll be able to proceed to make use of your favorite class bank card to make sure that you get most cashback or miles.

So the following time you see the SGQR code with the Fave emblem (confer with picture above), use FavePay to make cost as an alternative to be able to earn each immediate accomplice cashback and bank card rewards!

Even higher can be the under superb state of affairs:

| Companion cashback | As much as 20% |

| Bank card rewards | 4 miles per greenback or 8 – 10% cashback |

That’s as a result of every time you pay with Fave, you additionally get an immediate accomplice cashback (of as much as 20%) which could be utilised to offset future transactions on the similar retailer. Should you frequent the service provider pretty usually, this shouldn’t be an issue for you as a lot of the accomplice cashback are legitimate for 90 days.

Listed here are some well-liked FavePay retailers you can begin utilizing FavePay with:

- Breadtalk (3% Cashback)

- Gongcha (8% Cashback)

- Jolibee (5% Cashback)

- Sakae Sushi (5% Cashback)

- Nan Yang Dao (3% Cashback)

- Dian Xiao Er (3% Cashback)

- Fei Fei Wanton Noodles (10% Cashback)

- Acquire Metropolis (1% Cashback)

- Harvey Norman (1% Cashback)

- Marks and Spencer (2% Cashback)

- Poke Principle (5% Cashback)

Should you frequent any of the above retailers, you’d wish to obtain the app onto your cellphone now so that you’ll now not miss out on the cashback (which it is best to have gotten all this whereas)!

Get $5 off your first transaction (min. spend: S$15) with the code FAVENEWBB5 (click on right here) from now till 31 October 2024.

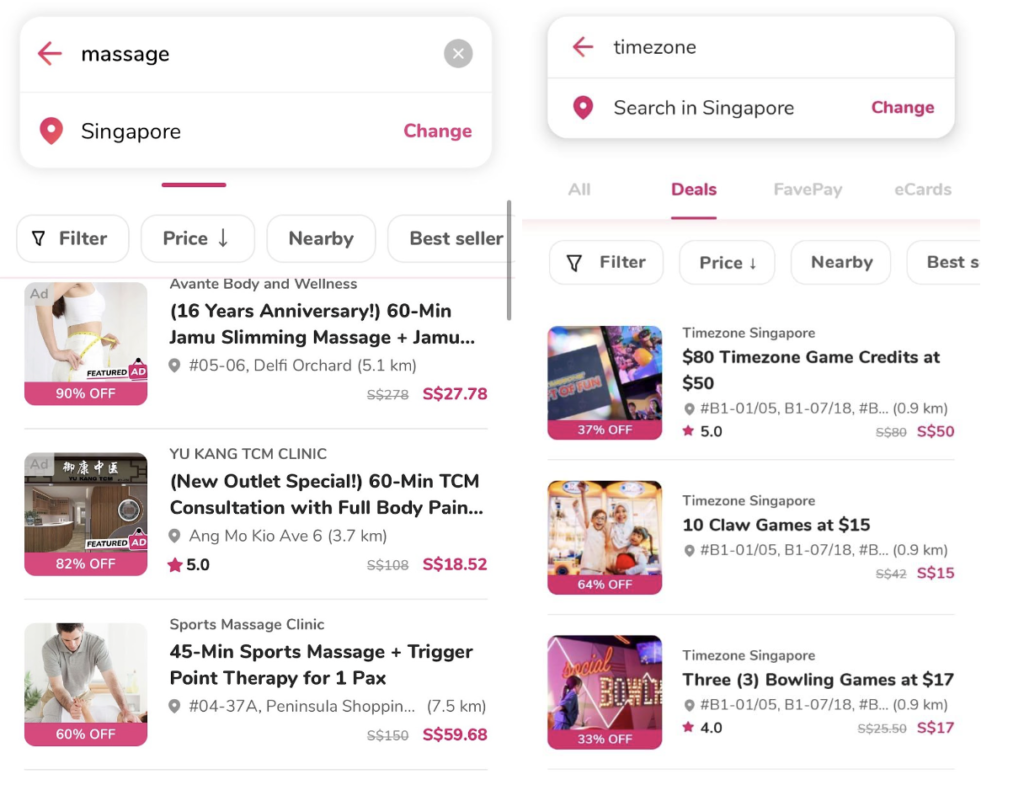

Tip 2: Take a look at unique Fave Offers for on-line or bodily retailer redemption

Everybody loves lobangs, particularly unique ones that you may’t discover elsewhere.

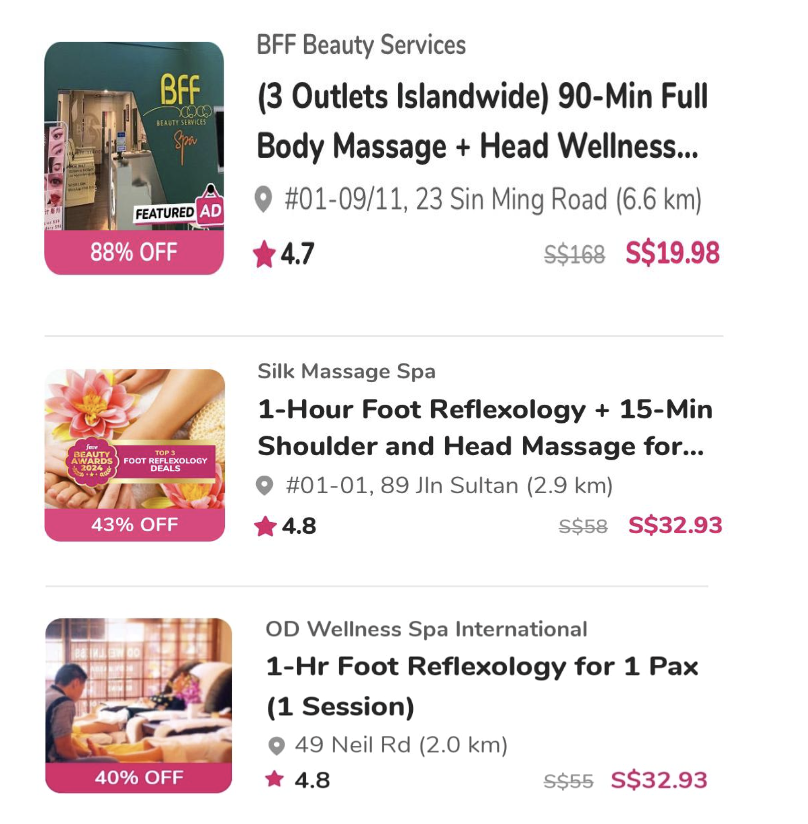

You’ll discover that in Fave Offers, which is unique to the Fave platform so that you can buy for on-line or bodily retailer redemptions. This wants somewhat scrolling (or you’ll be able to simply seek for your favorite retailers), however for what it’s value, it can save you as much as 90% off on sure offers throughout meals and drinks, magnificence and wellness, actions or different retail retailers.

As an illustration, dad and mom would most likely recognize the Timezone deal, the place we get to avoid wasting $30 and get $80 value of Timezone credit (sufficient to maintain my youngsters comfortable for no less than 3 visits). I additionally noticed offers for magnificence and therapeutic massage companies on the app. Since I don’t have an everyday therapeutic massage place or therapist that I frequent, I recognize these offers that permit me to ease my physique aches (sigh, I’m getting previous liao) at a trial value.

You’ll be able to even snag offers similar to 1-for-1 drinks at Gong Cha and Coconut Queen, or perhaps a 1-Day Health club and Yoga Cross (2 Pax) going for a steal at simply $9!

Tip 3: Buy discounted eCards to scale back your invoice

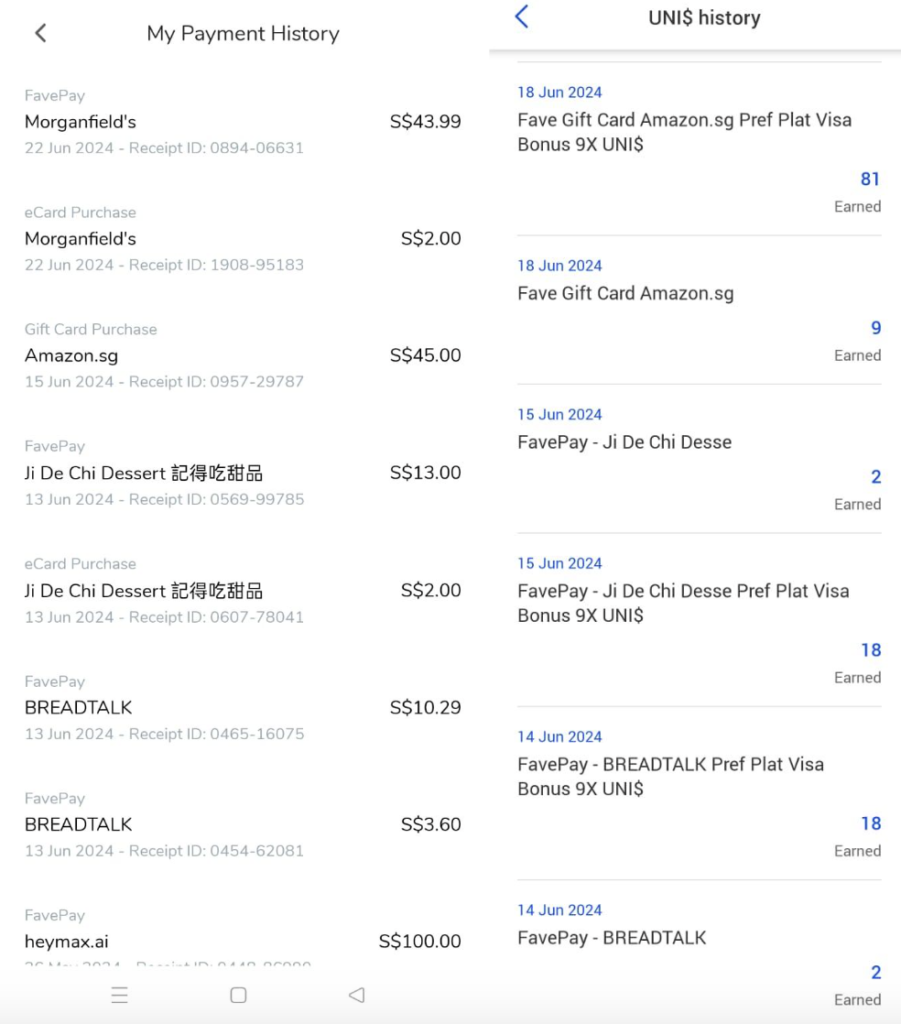

I had a number of current encounters with Fave that confirmed me the facility of those discounted eCards.

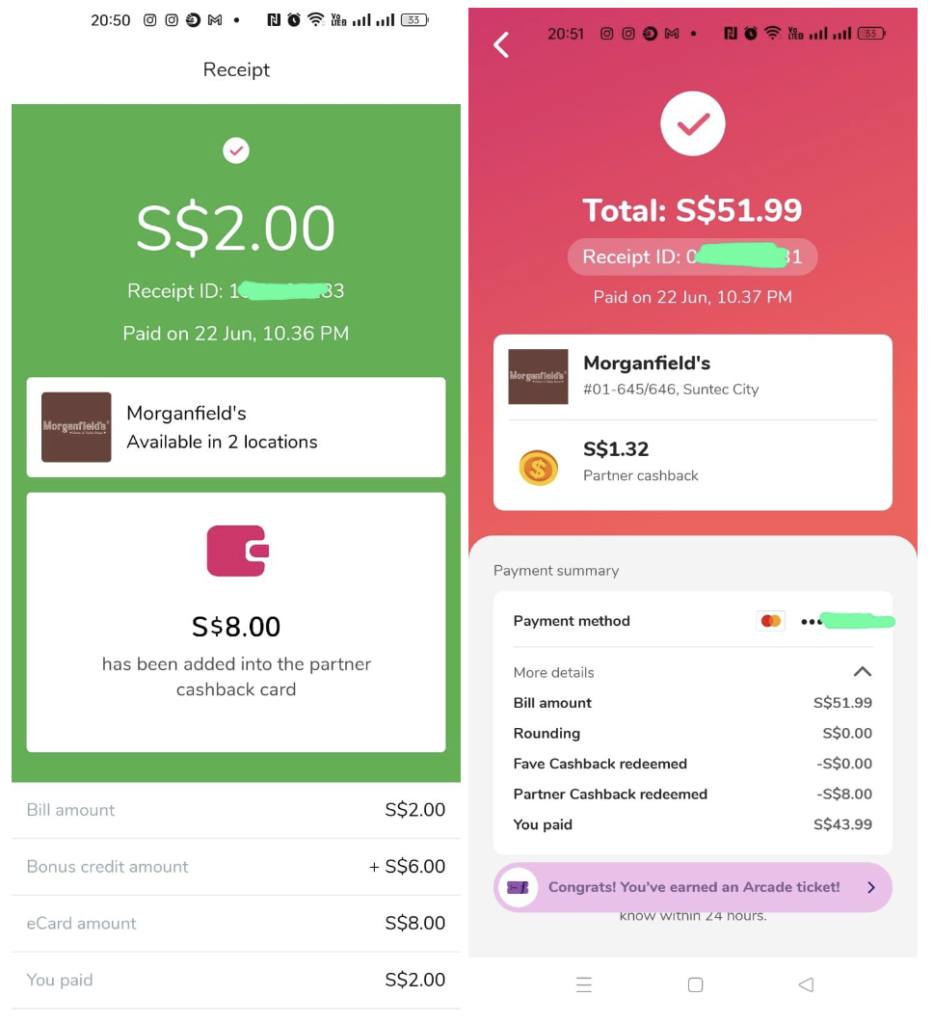

The primary time it occurred was after I was eating at Morganfield’s. I seen there was an choice to pay by way of FavePay, so I went to scan the QR code and the app instantly prompted me that there was a $2 Morganfield’s eCard for $8 worth that I might buy. This then diminished my invoice from $51.99 right down to $45.99 i.e. an immediate $6 financial savings for little or no effort!

Fave eCards are discounted vouchers obtainable at over 1,400 shops islandwide. These can be utilized concurrently throughout your FavePay checkout for max financial savings.

Some well-liked eCards trending on the app proper now embody:

- WELCIA-BHG – Pay $95, Get $100

- BHG – Pay $77, Get $88

- Kei Kaisendon – Pay $27, Get $30

- Lovet – Pay $140, Get $150

- Teo Heng KTV Studio – Pay $92, Get $100

Begin making it a behavior to pay with FavePay everytime you see the QR code, and also you is perhaps shocked by the financial savings you will get!

Tip 4: Purchase Fave Reward Playing cards strategically!

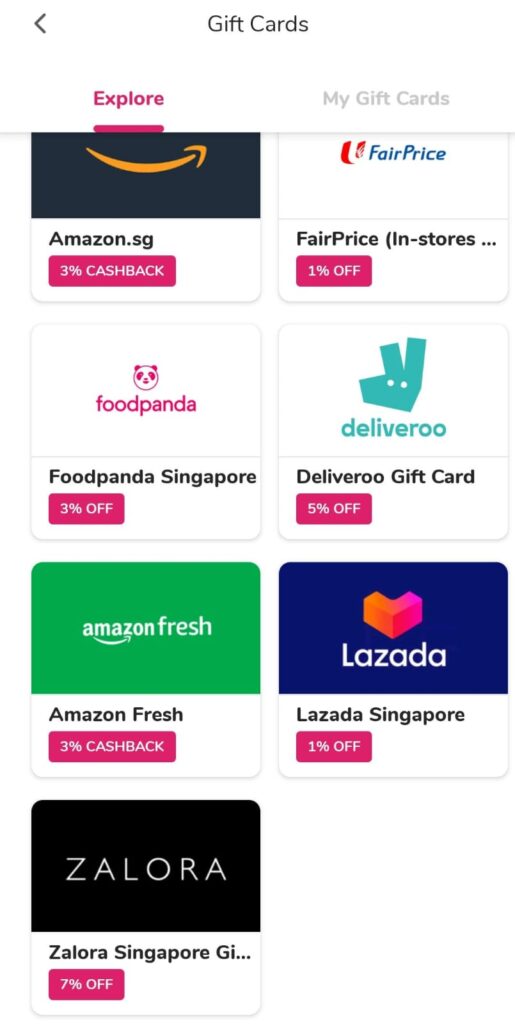

Should you store at Amazon Singapore, FairPrice, Foodpanda, Deliveroo, Lazada or Zalora, you would possibly wish to begin shopping for reward playing cards on Fave to offset your spending.

That’s as a result of Fave offers Reward Playing cards which are usually offered at a reduction, permitting you to avoid wasting immediately on on a regular basis bills with minimal effort. Or, for some manufacturers, Fave awards you with Fave Cashback simply from buying a Reward Card.

Reward Playing cards differ from Fave eCards as you shouldn’t have to make use of them by means of FavePay; as an alternative, you should utilize them on the service provider’s personal web site or retailer!

Should you’re as budget-conscious as I’m, you might have additionally seen that many of those retailers concurrently provide reward playing cards or vouchers on different platforms similar to ShopBack or HeyMax.

So how do you determine the place to buy from?

That actually boils right down to what you worth extra.

I’ll use Amazon.sg’s reward card for example:

| Fave | HeyMax | ShopBack | |

| Financial savings | No (or as much as 10% reductions throughout sure promo intervals) |

No | No |

| Cashback | 3% cashback

(as much as 6% cashback throughout promo interval) |

3-4 Max Miles on Mondays | Sure |

| Bank card rewards | Sure | Sure | Sure |

Miles chasers might desire to get Amazon reward vouchers off HeyMax, since that provides you extra mileage (pun meant). However when you care extra concerning the absolute {dollars} you’re paying, then shopping for it by means of Fave would doubtless be your best choice.

Throughout double-digit campaigns, you can even count on upsized cashback on Amazon Reward Playing cards. As an illustration, I snagged a ten% off Amazon reward card final month and shared about it on my Instagram right here.

All of it provides up!

From 8 to 11 September 2024, take pleasure in an unique 6% Fave Cashback on purchases of Amazon Recent or Amazon.sg reward playing cards through the use of the code AMAZONFAVESEPDD.

Should you didn’t snag that, fret not as a result of from now to 30 September (or whereas provides final), you’ll be able to obtain an immediate 3% Fave Cashback with the code, AMAZONFAVE.

Psst, I’ve heard from the Fave staff that extra reward card manufacturers will likely be added later this month. So, for all of your end-of-year purchasing, you’ll know simply the place to go!

What are the most effective playing cards to make use of with Fave?

Okay, now that the secrets and techniques of tips on how to maximise the app, let’s speak about which playing cards to make use of strategically with Fave in order that we will earn much more from our bank cards.

As a reminder, Fave converts your offline spending into on-line ones, however retains the underlying MCC. Therefore, the most effective miles playing cards to make use of can be:

Essential word: do NOT make the error of utilizing your DBS Lady’s World card with Fave, as Fave is excluded by DBS and won’t earn you the 4 mpd fee regardless of it being a web based spend!

For you cashback lovers, the most effective cashback playing cards to pair with Fave can be:

| Card | Class |

| UOB EVOL (10% cashback) | On-line spend |

| HSBC Reside+ (8% cashback till 31 Dec 2024) | Eating and purchasing |

| DBS Reside Recent (6% cashback) | Buying |

| UOB Absolute Cashback (1.7% cashback) | All |

| Citi Cashback+ (1.6% cashback) | All |

| Normal Chartered Merely Money (1.5% cashback) | All |

Whilst we grapple with inflation and rising value of residing, there are nonetheless methods to get extra out of your on a regular basis spending while you be taught to be strategic about utilizing options like Fave.

Now that we’re residing in an period the place we now not must accept simply incomes bank card factors alone, what’s stopping you from triple dipping your rewards?

Miles + cashback + reductions = that feels like an excellent mixture to me.

That’s why I’ll be utilizing Fave every time the chance arises.

How about you?

Sponsored Message

Should you’ve by no means used Fave earlier than (or haven’t opened up your app in a protracted whereas), right here’s a particular reader perk that the Fave staff is providing to all Finances Babe readers!Get $5 off your first transaction (min. spend: S$15) with the code FAVENEWBB5 from now till 31 October 2024.

Restricted to the primary 1,000 BB readers solely.This provide is relevant for each new and current Fave clients who've but to transact on the app earlier than.

Disclosure: This text was written in collaboration with Fave, whose staff fact-checked to make sure accuracy in all of the rewards I’ve written about.