State & native tax income from property taxes paid reached $203.9 billion within the third quarter of 2024 (seasonally adjusted), in line with the Census Bureau’s quarterly abstract of state & native tax income. This marks a 2.8% enhance from the revised $198.3 billion within the second quarter of 2024 and additionally marks the primary quarter the place property tax income topped $200 billion for state & native governments. 12 months-to-date, complete state & native tax income was $1.56 trillion. This was 5.4% larger than the $1.48 trillion by way of the primary three quarters of 2023.

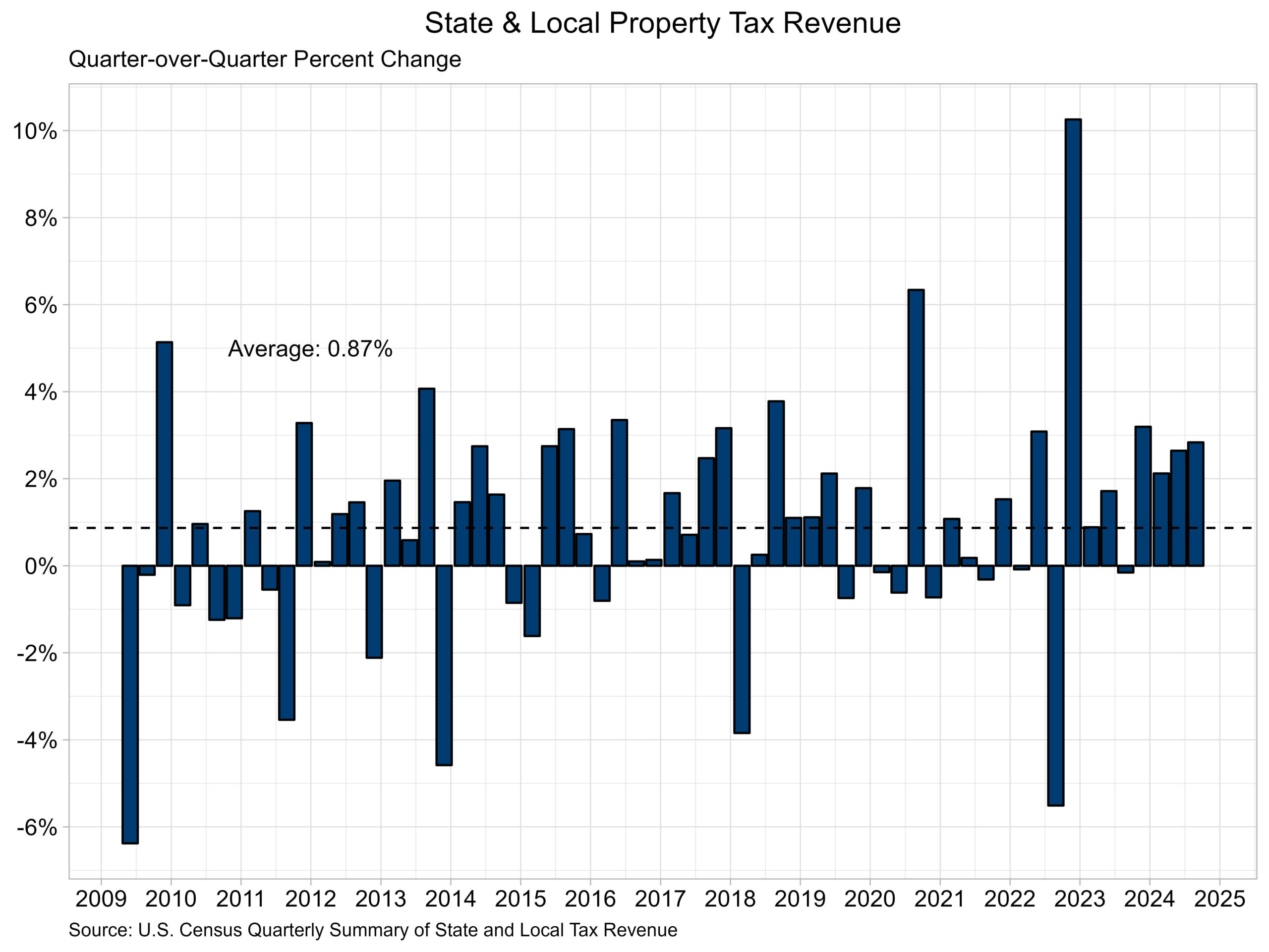

The two.8% quarterly enhance within the property tax income was up from the earlier quarter of two.6%. Property tax revenues have grown at a mean price of 0.87% from 2009 to 2024. This quarter marks the fourth consecutive quarter of above common progress.

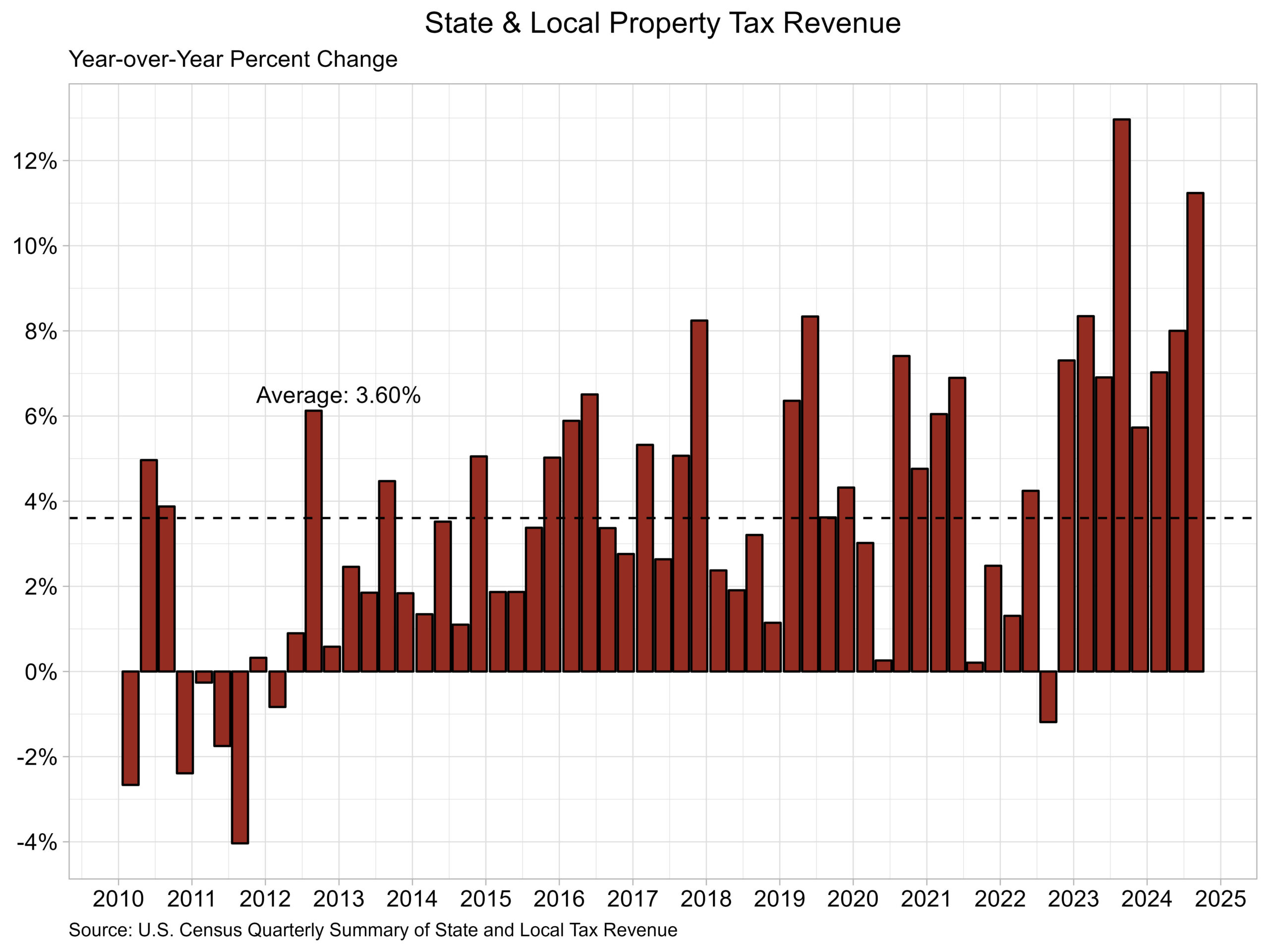

12 months-over-year, property tax income was 11.2% larger, a notable uptick from the 8.0% enhance within the earlier quarter. The typical year-over-year progress price from 2010 to 2024 is 3.60%. The final time yearly progress was under the common was the 1.1% decline within the third quarter of 2022.

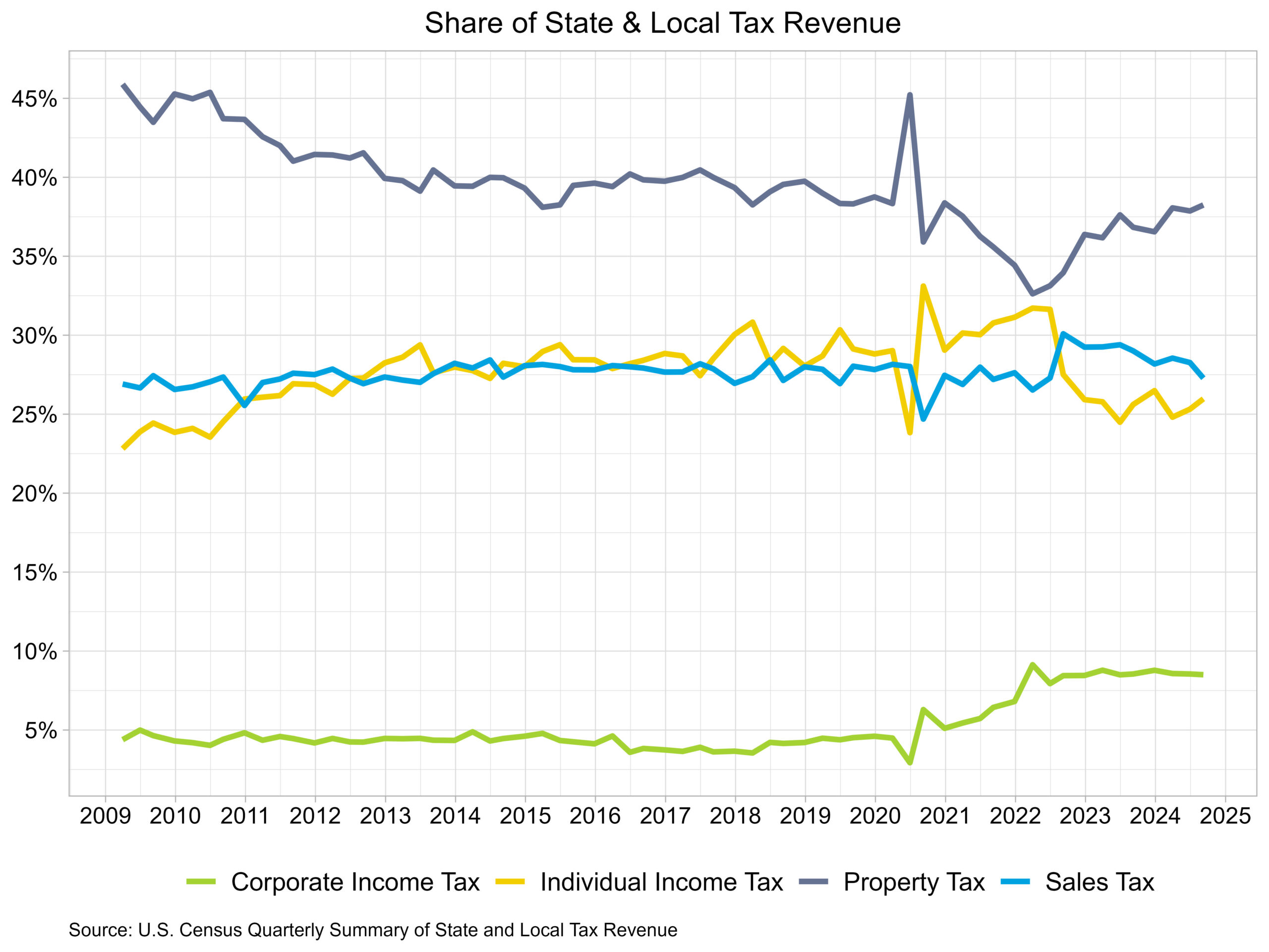

Of complete state & native collections within the third quarter, property tax made up the biggest share at 38.2%, adopted by gross sales tax at 27.3%. Particular person earnings tax represented 26.0% of tax income, whereas company tax made up the remaining 8.5% for state & native revenues within the third quarter of 2024.

Over the previous decade, state & native governments have been most reliant on property taxes for income. Gross sales tax has had an elevated significance since 2023, when the share of gross sales tax of complete revenues grew above particular person earnings tax shares. See the chart under for the tendencies of complete state & native authorities tax income shares.

Uncover extra from Eye On Housing

Subscribe to get the newest posts despatched to your e mail.