For some years now (for the reason that pandemic), I’ve been receiving E-mails from these within the Eurozone telling me that the evaluation I offered in my 2015 e-book – Eurozone Dystopia: Groupthink and Denial on a Grand Scale (revealed Might 2015) – was redundant as a result of the European Fee and the ECB had embraced and was dedicated to Fashionable Financial Idea (MMT) so there was now not a foundation for a critique alongside the strains I offered. I preserve seeing that declare repeated and apparently it’s being championed by MMT economists. Whereas there are some MMTers who appear to assume the unique structure of the Financial and Financial Union has been ‘modified’ in such a approach that the unique constraints on Member States now not apply, I feel they’ve missed the purpose. They level to the truth that the ECB continues to manage bond yield spreads throughout the EU by its bond-buying applications (sure) and that the Fee/Council relaxed the fiscal guidelines through the Pandemic (sure). However the bond-buying applications include conditionality and the authorities have now ended the ‘basic escape clause’ of the Stability and Development Pact and are as soon as once more imposing the Extreme Deficit process and imposing austerity on a number of Member States. The momentary leisure of the SGP guidelines (through the final emergency clause) didn’t quantity to a ‘change’ within the fiscal guidelines. Certainly, the EDP has been strengthened this yr. The Member States nonetheless face credit score threat on their debt, nonetheless use a overseas forex that’s issued by the ECB and is past their legislative remit, and are nonetheless weak to austerity impositions from the Fee and their technocrats. To check that state of affairs with a currency-issuing authorities such because the US or Japan or Australia, and so on is to, in my opinion, commit the identical form of error that mainstream economists make after they say that ‘the UK is susceptible to changing into like Greece’ or comparable ridiculous threats to self-discipline fiscal authorities in currency-issuing nations.

There are numerous interrelated questions that bear on this topic.

The primary pertains to whether or not the debt that issued by a authorities is topic to credit score threat or not.

A authorities that points debt to the non-government sector by bond market public sale mechanisms (normally) will not be topic to credit score threat if it might all the time meet the liabilities when the debt matures – that’s, must be repaid.

The selection of mechanism will not be actually the problem, neither is the capability of the central financial institution to buy the debt immediately reasonably than by the secondary bond market – that’s, after it has been issued to the first market sellers, who ‘make the market’ – that’s set the yields on the issued debt launch.

The query is straightforward sufficient – is there are state of affairs the place the issuing authorities wouldn’t be ready to satisfy the excellent legal responsibility?

If the reply isn’t any, then we consider that authorities as a sovereign forex issuer.

If the reply is sure, the alternative conclusion applies and that’s regardless of whether or not the actual authorities creates reserves within the business banking system when it spends.

The German authorities, for instance, creates reserves within the banking system when it spends however its debt is topic to credit score threat, not like, say the Australian authorities, which equally creates financial institution reserves when it spends, however faces no credit score threat on the debt it points.

The clear distinction between these to governments is that the German authorities makes use of the euro, whereas the Australian authorities points the $AUD.

Utilizing a forex is completely different to issuing it.

Marc Lavoie understood this distinction clearly in his 2022 journal article – MMT, Sovereign Currencies and the Eurozone – which was revealed within the Overview of Political Financial system (Vol 34, No 4, pp 633-646).

He isn’t an MMT economist though he wrote that “I agree with 93% of MMT” (the 93 per cent being a reference to George Stigler’s 1958 article – Ricardo and the 93% Labor Idea of Worth, which was revealed within the American Financial Overview, Vol 48, No 3, June 1958).

Marc Lavoie quoted from my 2015 e-book in clarifying the purpose:

… the bond traders know that the EMU nations face insolvency threat as a result of they should borrow to fund their commitments. Within the absence of any ECB help, these nations are reliant on the phrases set by the bond markets for any debt that they situation …

That assertion was on web page 196 of my e-book.

Marc Lavoie concludes that that is the “acceptable reply”:

… bond markets knew or thought that the ECB wouldn’t act as a purchaser of final resort for the governments that may be beneath the assault of speculators. It has not a lot to do with the frequent forex as such. It’s extra a matter of operational actuality — the conference that the ECB and the nationwide central banks of eurozone international locations wouldn’t do any outright intervention on secondary markets.

Despite the fact that we’re shut on the matter, I disagree together with his level that it has “not a lot to do with the frequent forex as such”.

In fact it’s primarily based on that actuality – as a result of if the Greek authorities might spend past its tax income with out having to hunt funds from the bond markets then it could by no means have been destroyed by the GFC.

Positive sufficient, it was not helped by the ECB which refused to purchase its debt to stabilise yields till a complete bail out plan was put in place – learn nation destroying set of situations.

However the root trigger was that it couldn’t run a deficit till it funded that deficit from the bond markets and the bond markets needed greater and better yields to compensate for the growing credit score threat.

It is likely to be mentioned that many countries which have their personal currencies face comparable difficulties as a result of they’ve guidelines or legal guidelines that stop the central financial institution from immediately funding the fiscal deficits.

However that additionally misses the purpose.

These governments have the legislative or regulative capability to change these voluntary constraints every time they see match and thus can avert a disaster from occurring.

The 20 Eurozone Member States can not individually legislate to command the ECB to do something.

The currency-issuer within the Eurozone, which has all of the monetary energy of a central financial institution wherever, is restricted in its capability by the Treaties that outline and govern the frequent forex.

These treaties are usually not the legislative or the regulative creation of the person Member States to differ at their particular person pleasure.

The second situation arose through the early years of the Pandemic, when the European Fee invoked the emergency clauses within the Stability and Development Pact (SGP), the fiscal guidelines framework that particulars the latitude (or lack of it) that the Member States face when crafting their fiscal coverage stances.

The emergency clauses successfully suspended the foundations framework, specifically the operation of the – Extreme deficit process (EDP) – which:

… is a mechanism designed to make sure that EU member states return to or keep self-discipline of their governments’ budgets … To restrict authorities deficit and debt, member states have agreed reference values, which they’ve enshrined within the EU treaties: a 3% deficit ratio and a 60% debt ratio. The ratios are all the time calculated relative to a member state’s GDP.

The lesson from the GFC was that even the automated stabilisers might power the fiscal final result for a selected nation to violate the three per cent rule.

That’s, the financial downturn was so unhealthy that the tax income loss and elevated welfare spending routinely pushed the fiscal steadiness past the three per cent threshold, with out the federal government taking any discretionary motion in any respect.

In the course of the GFC, the breaches of the fiscal limits invoked the tough austerity insurance policies beneath the EDP, which ravaged prosperity in lots of Member States.

With the onset of the Pandemic, no-one actually had a clue what the World was going through and governments and ruling authorities such because the European Fee (and Council) have been cautious and relaxed the fiscal guidelines for a interval.

Some MMT economists have since claimed that the choice to loosen up the SGP quantities to ending the Maastricht Treaty restrictions and successfully restores forex sovereignty to the person Member States.

A latest article by Ehnts and Wray within the Overview of Political Financial system – Revisiting MMT, Sovereign Currencies and the Eurozone: A Reply to Marc Lavoie – asserts that:

… whereas there was an issue with the unique set-up of the Euro system, this has been resolved within the aftermath of the worldwide monetary disaster and the more moderen COVID pandemic.

I disagree fully with this evaluation.

The authors go on to say that:

The 2020 Pandemic Emergency Buy Program (PEPP), which has been changed by the Transmission Safety Instrument (TPI), got here straight out of MMT logic. So long as the ECB acts as vendor of final resort in authorities bonds, nationwide governments is not going to lose entry to their nationwide central banks which make funds for and on behalf of the governments by crediting the reserves of banks that then credit score accounts of recipients.

They level to Mario Draghi’s assertion in July 2012 that “the ECB is able to do no matter it takes to protect the euro” because the tipping level the place the Eurozone Member States turned extra just like the US federal state than a US state, beneath the foundations of the European Treaties.

Operationally, they declare that it meant that the ECB would be certain that no Member State authorities would turn out to be bancrupt.

However this was fairly a distinct pledge to the traditional operational actions of a central financial institution say in Australia or the US throughout a deep disaster, which ensures, for instance, that the business banking system doesn’t collapse or that large-scale authorities help typically can proceed.

For instance, through the early years of the pandemic, the RBA bought a big proportion of the debt issued throughout that interval by the Australian authorities.

But it surely didn’t require something in return.

The distinction with Draghi’s ECB interventions, which actually started pre-Draghi in Might 2010 with the introduction of the Securities Market Program that stabilised bond yield spreads within the early disaster interval, was that the ECB demanded harsh conditionality in return for getting the federal government bonds of the Member States.

And, it refused to buy the Greek authorities bonds beneath the sooner variations of their bond-buying applications (which developed over time utilizing an array of descriptive names) as a result of the Troika needed to destroy any resistance to austerity.

Even in June 2015 when the nation voted towards continued austerity, the ECB did the unthinkable (for a central financial institution) and threatened the monetary viability of the Greek banking system until the federal government rejected the peoples’ vote, which after all it did.

When the Tsipras Syriza authorities – parading as a Left-wing authorities – embraced harsh austerity beneath the – Third Financial Adjustment Programme for Greece – they’re recognising that the ECB would implement insolvency of all the monetary system to make sure the Troika achieved its goal of retaining the nation inside the frequent forex.

So there’s a world of distinction between the ECB shopping for authorities bonds within the secondary bond market and successfully ‘financing’ the fiscal deficits of Member States and the RBA shopping for Australian authorities bonds within the secondary bond market through the early interval of the pandemic.

The authors then say that:

The pandemic lastly lifted the really constraining constraints: the reluctance of the ECB to behave as vendor of final resort and leisure of the deficit limits discovered within the Stability and Development Pact.

The ECB was by no means actually reluctant to buy the Member State debt in secondary markets.

As soon as it was confronted with the GFC actuality and it knew that the flawed structure of the frequent forex meant that it was inevitable among the nations (together with Italy, which was the most important worry) would face insolvency, it adopted its fiscal function after which papered over the truth that it was appearing in violation of the ‘no bail out’ clause (Article 123) of the Treaty on the Functioning of the European Union, by claiming that the bond purchases have been simply liquidity administration operations.

In fact, the size of the bond purchases have been multiples of what can be required for orderly ‘liquidity administration’ operations, however so long as they stored saying it the pragmatic components within the coverage hierarchy (Fee, Council and so on) might look the opposite approach.

However as famous above, the intervention was not ‘free’ and required the Member States to interact in harsh austerity beneath the EDP guidelines which in lots of circumstances devastated the prosperity of the residents affected.

It’s apparent that the ‘leisure of the deficit limits’ through the Pandemic has additionally given the Member States some latitude that they didn’t have through the GFC.

The truth is that many governments have been reluctant to make use of the latitude sufficiently to stop destructive outcomes as a result of they feared that the final word changes that may be required when the EDP guidelines have been enforced once more and the emergency clause terminated can be worse than in the event that they maintained their fiscal outcomes inside the regular SGP thresholds.

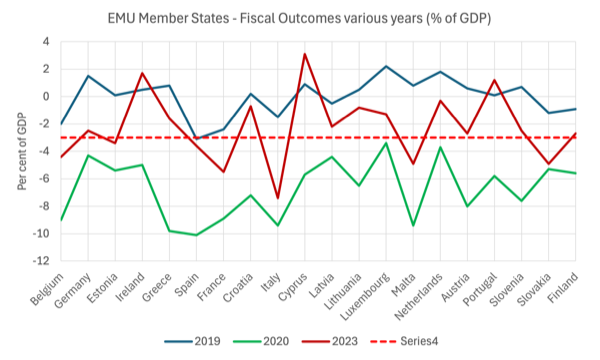

The next graph reveals the fiscal behaviour since 2019.

The authors characterise the submit pandemic state of affairs as:

… the ECB as soon as once more assumed the function of vendor of final resort … and the European Fee modified guidelines in order that nationwide governments might use fiscal coverage to handle macroeconomic issues.

As a matter of readability:

1. The ECB didn’t ‘as soon as once more’ assume the function – it has maintained a bond-buying program frequently since mid-2014 (though the SMP launched in Might 2010 predated the present variations).

See – Asset buy programmes – for extra particulars.

2. The Fee didn’t change guidelines through the pandemic.

It simply invoked a clause inside the present rule.

That distinction in characterisation is essential.

The Fee/Council didn’t abandon the SGP.

It didn’t abandon the surveillance mechanisms.

It didn’t abandon or deactivate completely the EDP guidelines.

Certainly, since April 30, 2024, the “EU’s new financial governance framework” has been strengthened – in its austerity bias (Supply).

The brand new framework, is only a new iteration of the SGP guidelines and associated procedures.

1. The Fee informs the Council that the Member State is in breach of the three per cent restrict.

2. The Council deliberates and adopts the Fee’s adjustment course of for rectification.

3. The Member State has 6 months to introduce the austerity.

4. Failure to take action invokes sanctions scaled to GDP which have to be paid each 6 months the nation is in default of the fiscal guidelines.

5. “The member state involved doesn’t have a vote” in these deliberations.

None of these procedures tells me that the EMU has turned the nook into a brand new world of fiscal freedom on the Member State stage.

The ECB might proceed to manage spreads however it will likely be lock-step with Brussels in imposing these guidelines.

Additional, the authorities have now ended the final escape clause:

On account of COVID-19, the EU suspended its budgetary guidelines for all member states between 2020 and 2023 by activating the final escape clause. As of 2024, the final escape clause is now not in impact. The EU has subsequently relaunched the deficit-based EDP course of beneath the brand new guidelines of the revised financial governance framework.

Already:

On 26 July 2024, following the Fee proposal, the Council adopted selections establishing the existence of extreme deficits for Belgium, France, Hungary, Italy, Malta, Poland and Slovakia.

And:

Beneath the brand new guidelines, all member states want to organize nationwide medium-term fiscal-structural plans. These should comprise a web expenditure path.

So to characterise the momentary leisure of the SGP through the pandemic as a brand new period for the EMU which displays “MMT logic” is far-fetched.

The intent in Brussels (and I’ve shut contacts with officers there) and among the many Eurosystem of central banks (once more shut contacts) is that the rules-based system might be enforced because it has been for the reason that inception.

The ECB did announce a brand new model of its bond-buying applications, the so-called – Transmission Safety Instrument (TPI) – which changed the – Pandemic emergency buy programme.

The situations beneath the TPI are clear:

1. “compliance with the EU fiscal framework: not being topic to an extreme deficit process (EDP), or not being assessed as having didn’t take efficient motion in response to an EU Council suggestion beneath Article 126(7) of the Treaty on the Functioning of the European Union (TFEU).”

2. “absence of extreme macroeconomic imbalances: not being topic to an extreme imbalance process (EIP) or not being assessed as having didn’t take the advisable corrective motion associated to an EU Council suggestion beneath Article 121(4) TFEU.”

3. “fiscal sustainability: in ascertaining that the trajectory of public debt is sustainable”.

So the bond-buying help of the ECB continues (masquerading as a standard financial operation) however so does the conditionality and not one of the Member States can change the conditionas unilaterally or collectively, for that matter.

The pandemic leisure was a brief aberration within the EMU’s relentless neoliberal pursuit of austerity.

The local weather emergency might invoke an additional leisure.

However that doesn’t characterize a basic change within the fiscal standing of the Member States.

They continue to be forex customers topic to strict fiscal guidelines that aren’t democratically derived.

Lastly, it was fascinating that the authors in coping with Marc Lavoie’s level that “there’s a disagreement inside MMT on the reply to the query” (about whether or not the Member States are sovereign and forex issuers) solely refer to a couple MMT choices and solely seek advice from my 2015 e-book in a footnote:

What Mitchell (2015) wrote in regards to the Euro is in line with our view. When you perceive that the euro is a supra-national forex, it turns into clear that becoming a member of the Eurozone was certainly an issue given the setup whereas it’s nonetheless true that the bond market is impotent for nations that situation their very own forex, as an example. As we’ve seen, the Eurozone might be reconfigured in order that the bond market is impotent for a supranational forex as properly.

I disagree.

Saying that the bond market is impotent within the EMU so long as the ECB acts to stabilise yield spreads whereas ignoring the truth that the ECB additionally concurrently required harsh austerity misses the purpose of my 2015 work.

The query is would the ECB nonetheless act in that approach if the nationwide authorities refused to reject the conditionality (austerity)?

Effectively we all know the reply: No, simply take a look at what they did with Greece in 2015 when the individuals rejected the austerity and the ECB successfully pressured the nation to the brink of insolvency.

Conclusion

There’s thus basic disagreement amongst MMT economists in regards to the Eurozone.

You’ll be able to work out which facet you might be on.

That’s sufficient for as we speak!

(c) Copyright 2024 William Mitchell. All Rights Reserved.