Chances are high, you doubtless have utilized for a bank card to assist repay private bills and construct credit score. However, have you ever gotten a enterprise bank card but? If not, it’s time to learn to get a enterprise bank card.

Advantages of enterprise bank cards for startups

There are benefits of getting a bank card for once you get began and as your online business grows. To see advantages in your online business, you want to sustain along with your funds.

1. Construct enterprise credit score

Getting financing for small enterprise ventures is so much simpler should you’ve taken the time to construct sturdy enterprise credit score. Collectors might give you the next line of credit score.

However as a startup, you don’t have enterprise credit score. You construct credit score by paying money owed on time. For those who sustain along with your funds, a enterprise bank card will help construct your startup’s credit score.

2. Assist monitor bills

Enterprise bank cards for startups preserve private and enterprise bills separate. It may be arduous to determine what purchases are private bills and what are enterprise bills when you’ve one, mixed report. Combining monetary data makes it more and more tough to know your organization’s true monetary figures.

However, a separate enterprise bank card offers you entry to a press release with solely enterprise bills. You possibly can match your bank card assertion to your on-line accounting data to make sure your monetary knowledge is correct.

A enterprise bank card assertion can be useful throughout tax time. Whenever you file taxes, you want to report your organization’s revenue and bills. When your online business bills are already compiled on a bank card assertion, it could be simpler to report data.

3. Shared entry to funds

You possibly can authorize others to make use of your online business bank card. By authorizing a number of card customers, it can save you time and delegate duties.

For instance, should you personal a building firm, you would authorize an worker to make use of the enterprise bank card. The worker can go to the ironmongery shop and decide up provides with the cardboard. You don’t have to preserve operating out for supplies. As a substitute, you’ll be able to deal with operating and rising your online business.

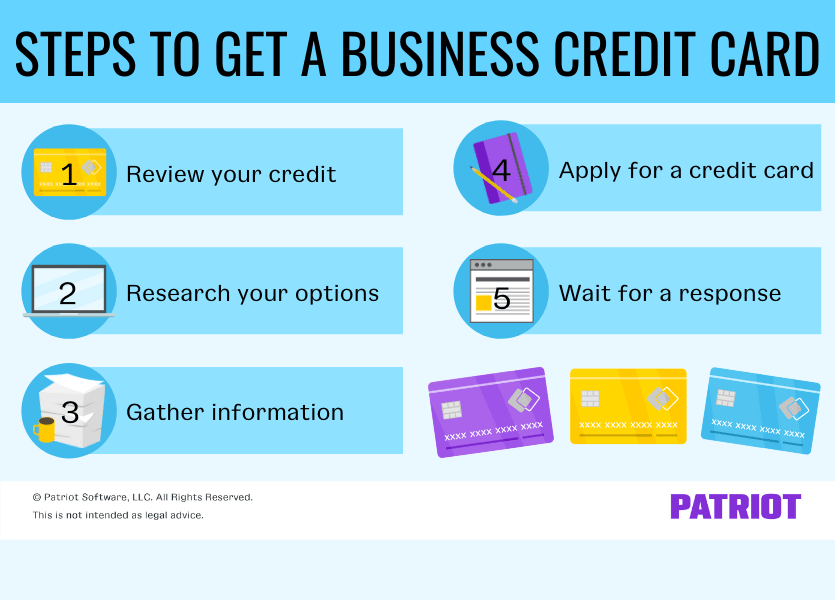

Tips on how to get a enterprise bank card: 5 Steps

Enterprise bank cards for startups assist you to entry the day-to-day funds that you simply want. Opening a enterprise bank card is an thrilling time in your firm.

A bank card for enterprise will help you construct up credit score, shield your organization financially, entry rewards (e.g., earn money again), and simplify money circulation. To not point out, it will possibly assist you to juggle bills.

Getting a enterprise bank card is straightforward for startups. However, it’s necessary to take your time by way of the method. Store round for a bank card firm and sort that matches your wants. Additionally, make sure to learn the phrases fastidiously earlier than accepting.

There are a number of steps it’s best to take earlier than you apply for a enterprise bank card.

1. Evaluation your credit score

Whether or not it’s your first time getting a enterprise bank card otherwise you’ve gone by way of the method just a few occasions, reviewing your credit score scores and experiences is at all times a good suggestion. Earlier than making use of for a enterprise bank card, have a look at your private and enterprise (if relevant) credit score.

Each your private and enterprise credit score can influence whether or not or not an issuer will settle for your online business bank card software. And should you don’t have enterprise credit score but, lenders have a look at private credit score to find out their determination. Lenders may additionally have a look at private revenue, enterprise income, and bills.

Enterprise and private credit score matter as a result of they present whether or not or not you’ll be able to afford to repay your bank card stability and are dependable with funds.

You possibly can overview your credit score data by credit score experiences, corresponding to Experian and Equifax. When pulling credit score historical past and offering confidential data for experiences (e.g., Social Safety quantity), be sure to use a dependable and safe credit score firm.

For those who don’t have enterprise credit score but or don’t have established credit score, chances are you’ll have to work on increase your credit score earlier than you’ll be able to obtain approval. To offer your credit score a lift, you’ll be able to:

- Get an Employer Identification Quantity (EIN) should you don’t have one

- Incorporate your online business

- Open a enterprise checking account

- Begin small (e.g., apply for a secured bank card)

- Make funds on time

Good credit score helps you get authorized for a decrease rate of interest and the next spending restrict. However, your software may very well be denied if in case you have poor private credit score.

2. Analysis your online business bank card choices

As soon as your credit score is in an excellent standing, begin doing all your homework to seek out out which enterprise bank card(s) you need to apply for.

There are a variety of several types of enterprise bank cards to select from. So, perform a little research earlier than filling out any functions. When researching enterprise bank cards, have a look at elements like:

- Charges

- Rates of interest

- Advantages (e.g., rewards)

Additionally, think about what you can be utilizing the bank card for. Will you be making massive purchases with the cardboard or smaller purchases? Are you wanting a enterprise bank card to assist earn money again for your online business? Ask your self these questions and extra to unravel which card is finest for your online business.

After you slender down some playing cards, examine their execs and cons facet by facet to find out which card (or playing cards) to use for.

3. Collect data to use

Have a good suggestion of which enterprise bank card you need to apply for? Nice! Now it’s time to collect some data.

Earlier than you’ll be able to apply for a enterprise bank card, be sure to have the next data helpful:

- Private data

- Identify

- Date of start

- Social Safety quantity (SSN)

- Residence deal with

- Annual revenue

- Cellphone quantity

- Month-to-month lease or mortgage cost

- Private debt

- Enterprise data

The extra data you’ve ready, the higher off you’ll be. And, the faster you’ll be able to fill out a enterprise bank card software and (hopefully) get authorized.

Ensure you know the enterprise bank card software necessities earlier than making use of. That manner, you understand what to anticipate and may put together forward of time.

4. Apply for a bank card

After you collect all the data you want, now comes the enjoyable half: Signing up for a enterprise bank card.

So long as you’ve gathered the required data, making use of shall be a breeze. More often than not these days, you’ll be able to apply instantly on-line. And, it sometimes solely takes a couple of minutes.

In some circumstances, chances are you’ll want to supply comply with up data or documentation to the bank card firm. This can be one of many steps on-line. Or, they could name or e mail you to collect the remainder of your data.

For some enterprise bank cards, chances are you’ll obtain a response just a few seconds or minutes after making use of. Nevertheless, relying on the cardboard you apply for, chances are you’ll have to…

5. Look ahead to a response from the cardboard issuer

Once more, you usually get a fast response when making use of for a enterprise bank card. However generally, it could take a little bit longer to listen to again. How rapidly a bank card issuer approves or denies your bank card software can differ relying on:

- How the bank card firm works

- The data you offered

- Your private and enterprise credit score scores

- What number of playing cards you’ve utilized for in the previous few months

For those who don’t get a dedication instantly after making use of, don’t panic. Simply wait and see should you’re authorized. Usually, the bank card issuer will attain out to you inside a few enterprise days through telephone name or e mail with their response.

For those who’re authorized for the enterprise bank card, you’ll obtain your bank card through mail per week or two after approval (yippee!).

For those who’re denied, don’t hand over but. Usually, the corporate offers you a motive why they rejected your software (e.g., not sufficient credit score constructed up). For those who actually have your coronary heart set on a sure enterprise bank card, make some changes and reapply in just a few months.

| Want a straightforward solution to monitor revenue and bills for your online business? Patriot’s on-line accounting makes it a breeze to handle your books so it can save you time for what issues most: your online business. Strive it free for 30 days as we speak! |

This text has been up to date from its unique publication date of August 19, 2021.

This isn’t supposed as authorized recommendation; for extra data, please click on right here.